When it comes to drink and snack firm PepsiCo (PEP), activist hedge fund Elliott Investment Management is pushing for change at the company. Indeed, earlier this month, Elliott revealed a $4 billion stake and released a detailed report that called for PepsiCo to cut costs, drop underperforming brands like Quaker, and potentially spin off its bottling business. Elliott argues that splitting off bottling, much like Coca-Cola (KO) did years ago, would raise margins and create a more focused organization. However, some investors are cautious about separating its bottling business, according to Reuters.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In fact, they warn that separating the business could be expensive, take years, and temporarily weigh on earnings. In addition, investors note that Coca-Cola’s similar move initially hurt its sales and profit before eventually improving margins. Still, since PepsiCo’s operating margins already trail Coca-Cola’s by as much as 10%, Elliott argues that refranchising could help close that gap. Nevertheless, despite this disagreement, other parts of Elliott’s plan, like selling smaller or slower-growth brands, have been better received.

Indeed, analysts say that Quaker alone could fetch around $6 billion, which is money that could help offset the costs of a bottling spin-off. And although PepsiCo has already been trying to refresh its portfolio by acquiring trendier brands such as Poppi and Siete, its U.S. soda business continues to lose ground to competitors. As a result, shares are down nearly 20% over the past year.

Is PEP Stock a Good Buy?

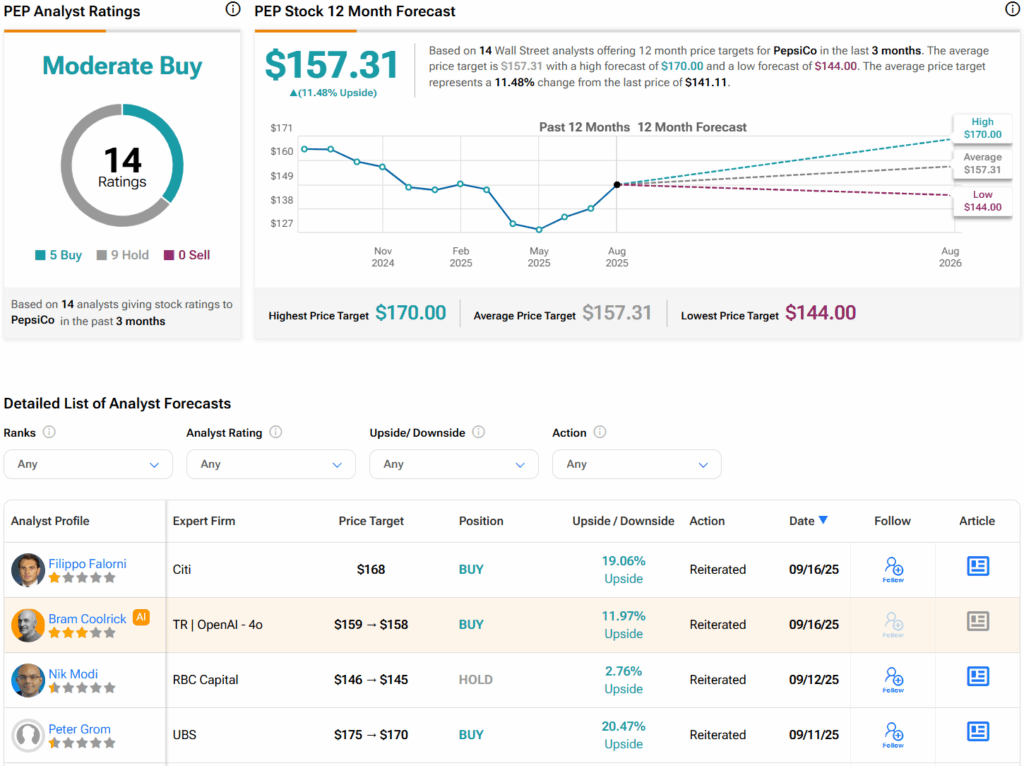

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PEP stock based on five Buys, nine Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average PEP price target of $157.31 per share implies 11.5% upside potential.