Solar stock investors have been wondering about the market’s near-term outlook for a while now. The CFO of SolarEdge (NASDAQ:SEDG), Ronen Faier, rolled out some projections to help answer those questions. Unfortunately, investors didn’t like what they heard and sent SolarEdge stock diving over 3% in Friday afternoon’s trading. Faier looks for electricity prices to decline while support from the Inflation Reduction Act increases. That, in turn, should prompt modest growth for the U.S. solar industry.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This is especially true as interest rates, which were a major impediment to the solar industry, start to decline. Indeed, trying to get a home loan was challenging enough, let alone a loan that included a solar-powered system. It will also help matters that the biggest solar markets, like California, are starting to see improvements from the Inflation Reduction Act as well. Just to top it off, battery installation is also on the rise, and manufacturers are starting to purge their inventories accordingly.

A Somewhat Mixed Bag

The current interest rates really can’t hold out much longer, not without sinking large portions of the economy. Further, a report from OPTO suggests that renewable energy, in general, could be in for a bit of a renaissance, especially solar. However, SolarEdge will have some troubles of its own to address. Particularly, there’s the matter of a brewing lawsuit against the company over matters of disclosure that no less than six different law firms are trying to head up.

Is SolarEdge a Good Stock to Buy?

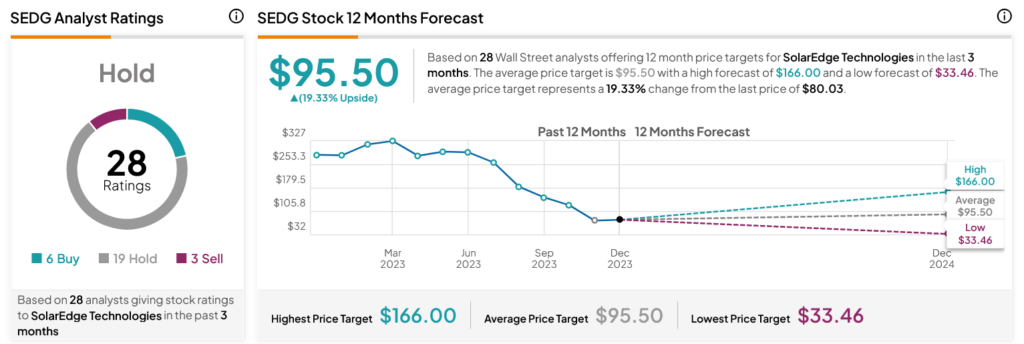

Turning to Wall Street, analysts have a Hold consensus rating on SEDG stock based on six Buys, 19 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. After a 71.4% rally in its share price over the past year, the average SEDG price target of $95.50 per share implies 19.33% upside potential.