For a while, Enphase Energy (NASDAQ:ENPH) was looking like the future of solar stocks. That was especially true after new remarks from Piper Sandler gave Enphase a solid outlook. Then Enphase’s earnings report came out, and it all went downhill from there. How far downhill? How’s down about 25% in Wednesday afternoon’s trading sound?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

At first glance, the plunge in Enphase’s share price is unfathomable. Enphase’s earnings turned in beats all around and by pretty healthy margins, too. Enphase posted earnings per share of $1.37, which handily beat projections calling for $1.21 per share. Revenue was also a beat, coming in at $726.02 million against projections looking for $720.51 million. Perhaps most amazingly of all, Enphase turned in revenue that was up 64.5% year-over-over.

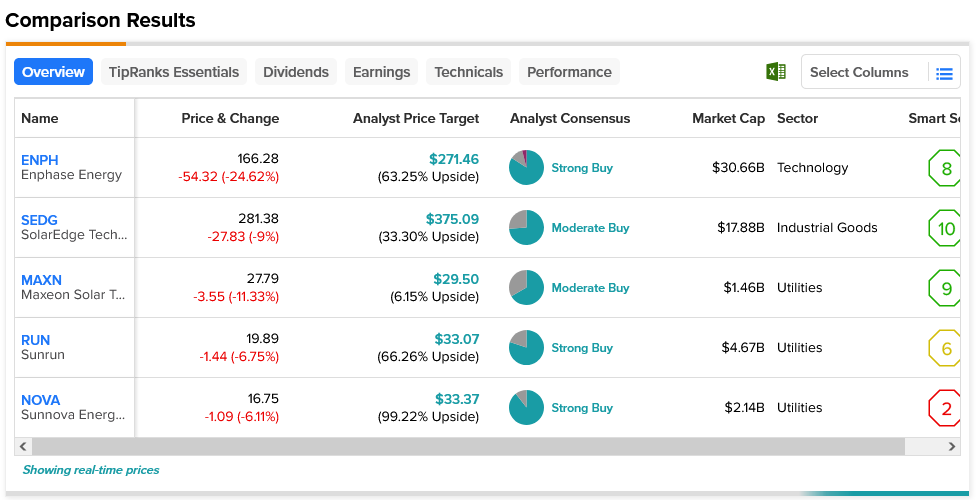

The big problem for Enphase, which sent it and several other solar stocks tumbling, was its future projections. Enphase looked to bring in between $700 million and $750 million, which didn’t match up against analyst consensus looking for $760 million. Maxeon Solar (NASDAQ:MAXN) was down just over 11%, while SolarEdge (NASDAQ:SEDG) was down 9%. Sunrun (NASDAQ:RUN) slipped 6.75%, and Sunnova Energy (NYSE:NOVA) lost 6.11%.

Of the aforementioned stocks, analysts expect the least from Maxeon, with a Moderate Buy consensus rating and just 6.15% upside potential. However, Sunnova fares much better; it’s considered a Strong Buy by analysts, and its $33.37 average price target gives it a hefty 99.22% upside potential.