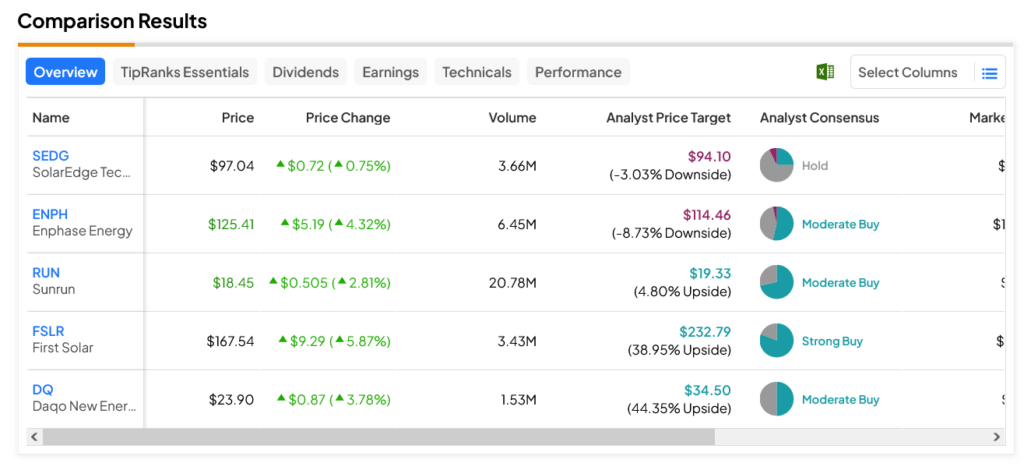

Today was fantastic for solar stocks, as a wide range of them all saw upward gains to one degree or another. SolarEdge (NASDAQ:SEDG) had only modest fractional gains, but it was unique in that regard. Sunrun (NASDAQ:RUN) added nearly 3% at one point, while Daqo New Energy (NYSE:DQ) gained nearly 4%. Enphase Energy (NASDAQ:ENPH) added over 4%, while First Solar (NASDAQ:FSLR) had the best day of all, up nearly 6%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The reason was fairly simple, and universal to the lot: it all stemmed from the Federal Reserve’s recent remarks about keeping the Federal Funds Rate where it was until at least the next meeting, with chances of cuts to follow in 2024. That’s universally good news for solar stocks, which are marked by high initial outflows of cash in hopes of recovering cash later from decreased power bills or the ability to continue normal living in a power outage. It also helps on the supply side as well, as solar companies need to get hands on the material required to perform a customer installation. That improves when capital is more readily available, like when interest rates are lower.

Building on Yesterday’s Gains

Interestingly, this seems to be something of a pattern. We saw a similar effect with stocks like Sunrun, Enphase and SolarEdge, all of which saw some gains yesterday for much the same reason. The gains actually continued into today’s session, which suggests that the narrative of rate cuts to come followed by recovery in solar could have some legs to it. It further helps to consider how solar installations are financed; usually, customers buy solar electricity from a provider using an agreement of 20 or 30 years. Then, the installer collects tax benefits or subsidies accordingly and finances long-term payments with mortgages or bonds. Thus, lower interest rates keep the costs of such an arrangement low.

Which Solar Stocks are a Good Buy Right Now?

Turning to Wall Street, the leader in the field is DQ stock, whose $34.50 average price target means a 44.35% upside potential for this Moderate Buy-rated stock.. Meanwhile, the laggard of the set was ENPH stock, as this Moderate Buy-rated stock comes with an 8.73% downside risk on its $114.46 average price target.