It’s been a disastrous few weeks for the banking sector, and trouble is spreading throughout the entire bank stock continuum. One of the latest hits landed with SoFi Technologies (NASDAQ:SOFI), which lost over 11% at the time of writing thanks to a shift at Wedbush.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wedbush, via analyst David Chiaverini, lowered its outlook on SoFi from “outperform” to “neutral” and offered a worthwhile note about SoFi’s performance. SoFi killed it in the first quarter, but Chiaverini also noted that SoFi didn’t exactly change its full-year forecast by much. This suggested that the phenomenal quarter was likely to be a one-off, and subsequent quarters would get worse. Moreover, Chiaverini also notes that the slipping platform fees SoFi saw in the first quarter will probably stay close to flat, giving it little help that way.

SoFi is trying to pivot by making a connection with Expedia (NASDAQ:EXPE) to create “SoFi Travel Powered By Expedia,” a travel package that allows SoFi members to get extra benefits when booking hotel stays and the like. Yet, at the same time, SoFi’s CEO, Anthony Noto, says that bank customers are looking for “…safer, more well-trusted banks and banking relationships.” Will they find these with SoFi, or one of the smaller neighborhood banks that dot the landscape? It’ll likely take a lot of convincing.

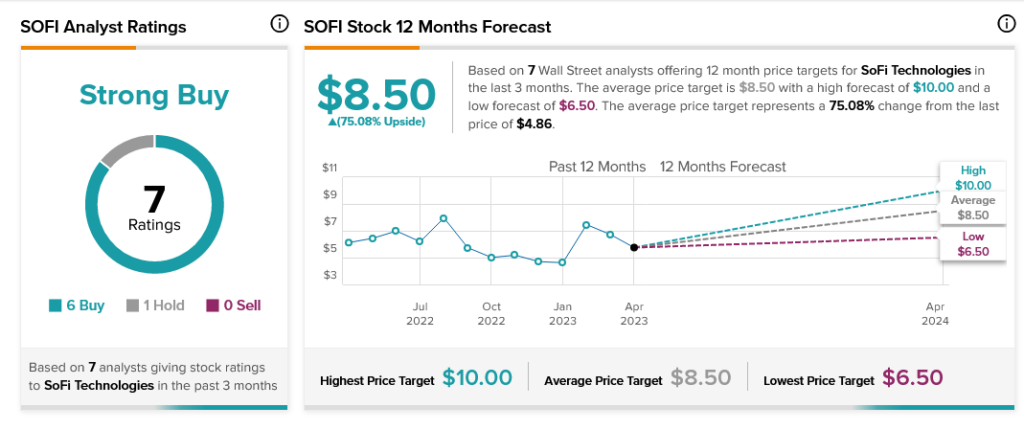

Analysts have a lot of faith in SoFi. With six Buy ratings against just one Hold, SoFi stock is considered a Strong Buy by analyst consensus. Further, with an average price target of $8.50, SoFi stock offers 75.08% upside potential.