Shares of SoFi (NYSE:SOFI) are lower today, which can be attributed to analyst downgrades. Mihir Bhatia from Bank of America changed his rating from Buy to Hold while assigning a price target of $10 per share. For reference, his previous price target was $9.50. In addition, Kevin Barker of Piper Sandler also downgraded the stock from Buy to Hold with a price target of $8, which was raised from $6.50.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The passage of the debt ceiling bill that ensures the end of the student loan repayment freeze by September bodes well for Sofi’s profitable student loan refinancing sector. While the analysts recognize the positive aspects of this change, they also warn that the benefits are likely already reflected in the stock’s price.

Furthermore, despite potential short-term boosts to Q3 estimates, SoFi’s 2023 outlook is unlikely to undergo significant changes. Interest rates’ recent rise due to persistent inflation could serve as a near-term challenge, tempering the advantageous lending opportunities that lower rates could offer.

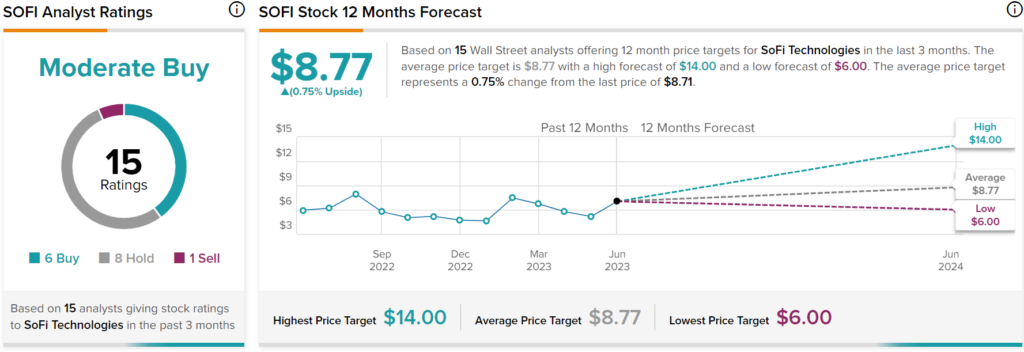

Overall, analysts have a Moderate Buy consensus rating on SOFI stock based on six Buys, eight Holds, and one Sell assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $8.77 per share implies 0.75% upside potential.