Shares of fintech company SoFi Technologies (NASDAQ: SOFI) went up in pre-market trading after the company reported results for the third quarter. The company’s losses narrowed in third quarter to $0.03 per share on an adjusted basis as compared to a loss of $0.09 per share in the same period last year. Analysts were expecting the company to report a loss of $0.08 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s adjusted revenues increased by 27% year-over-year to $530.7 million, surpassing analysts’ expectations of $511.3 million. SoFi added more than 717,000 new members in the third quarter; the total number of members rose by an incredible 47% year-over-year, reaching more than 6.9 million.

Anthony Noto, CEO of SoFi Technologies commented, “Record revenue at the company level was driven by record revenue across all three of our business segments, with 67% of adjusted net revenue growth coming from our non-Lending segments (Technology Platform and Financial Services segments).”

SoFi’s deposits jumped by 23% year-over-year to $15.7 billion by the end of the third quarter, with student loan originations of $919.3 million.

Looking forward, management raised its FY23 outlook and now expects adjusted net revenue in the range of $2.045 billion to $2.065 billion, up from its prior guidance between $1.974 million and $2.034 billion. The company anticipates full-year adjusted EBITDA in the range of $386 million to $396 million as compared to its prior guidance between $333 million and $343 million, representing a 48% incremental adjusted EBITDA margin.

What is a Fair Price for SoFi Stock?

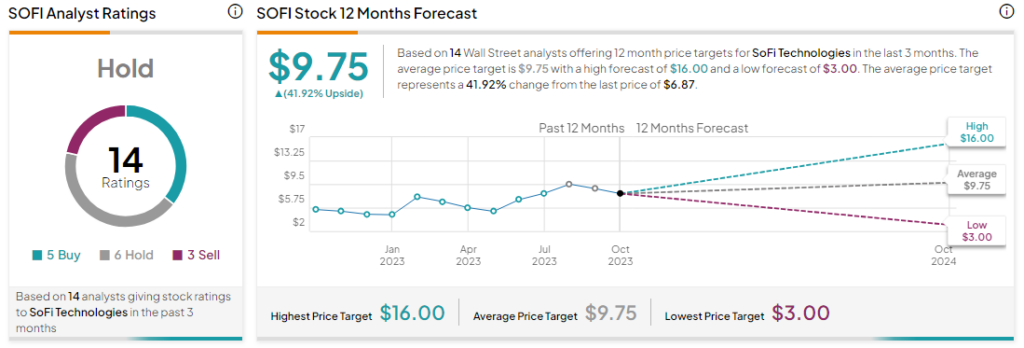

Analysts remain sidelined about SoFi stock with a Hold consensus rating based on five Buys, six Holds and three Sells. The average SOFI price target of $9.75 implies an upside potential of 41.9% at current levels.