Fintech and online banking platform SoFi Technologies (NASDAQ:SOFI) has decided to shut down its crypto business and has informed its customers that they can either close their crypto accounts or agree to migrate their crypto assets to Blockchain.com by December 19. The move comes amid increasing scrutiny of the crypto space by banking regulators.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

U.K.-based crypto services company Blockchain.com said that crypto account holders at SoFi will get access to dozens of tokens traded on its platform.

Rationale Behind SoFi’s Decision to Quit Crypto Business

While the company did not specify any reason for exiting the crypto services business, which started in 2019, it seems like the move is related to its decision to become a bank holding company, as noted by a Bloomberg report.

SoFi was granted a bank charter in January 2022 after it acquired Golden Pacific Bancorp. However, as per the company’s SEC filings, the approval of the bank charter was conditional and was subject to a two-year conformance period for its crypto business, with the company either receiving the required regulatory approvals to continue it or exit it in the absence of approvals.

SoFi’s crypto business did not account for a material part of its overall operations. The company held $139.4 million in digital assets as of September 30, 2023.

Is SoFi Technologies a Buy, Sell, or Hold?

While SoFi’s solid momentum in personal loans and the recovery in student loan refinancing following the end of the moratorium period are expected to drive additional growth, some analysts remain skeptical about the impact of a high interest environment on loan originations.

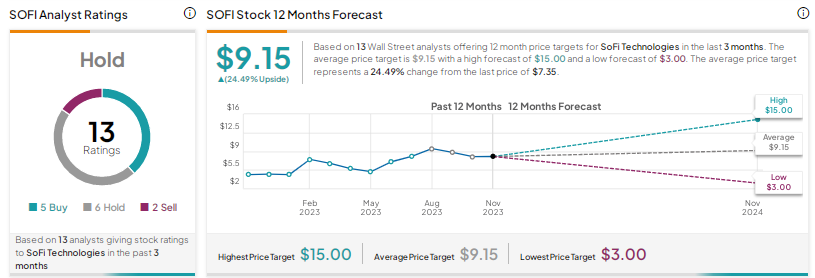

Wall Street has a Hold consensus rating on SOFI stock based on five Buys, six Holds, and two Sells. The average price target of $9.15 implies 24.5% upside potential. Shares have risen 59.4% year-to-date.