Shares of data warehousing giant, Snowflake (NYSE:SNOW), are trading higher at the time of writing. This came on the heels of the announcement of an expanded partnership with Microsoft (NASDAQ:MSFT) to venture into “large scale” generative AI models. The deal is set to boost product integration in Azure OpenAI, Azure ML, and more, significantly fostering collaboration and joint market initiatives.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The expanded integrations will allow joint customers to tap into the latest AI models and frameworks, subsequently improving developer productivity. Despite these advances, Brian White from Monness, Crespi, Hardt holds a neutral rating for Snowflake, stating that while it’s well-positioned for AI trends, concerns around margins, high valuation, and competition remain.

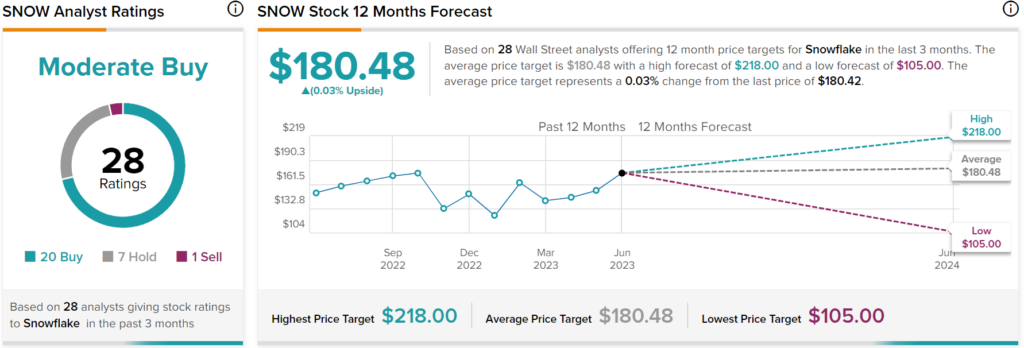

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SNOW stock based on 20 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $180.48 per share implies that shares are fairly valued.