Shares of Snowflake (NYSE:SNOW) fell in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2023. Earnings per share came in at $0.14, which beat analysts’ consensus estimate of $0.04 per share. Sales increased by 53.5% year-over-year, with revenue hitting $589.01 million. This beat analysts’ expectations of $575.45 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Snowflake offered product revenue of $555.3 million for its fourth quarter, which was 54% higher than it was this time last year. It now counts 7,828 total customers to its roster and features a net revenue retention rate of 158%. Perhaps best of all, it now counts 330 customers that have a 12-month product revenue figure of over $1 million. As a further benefit to shareholders, Snowflake established a $2 billion fund for share buybacks.

Management looks to produce $2.705 billion in product revenue during Fiscal Year 2023. Further, management expects first-quarter product revenue to be between $568M and $573M, representing a growth rate of 44% to 45% year-over-year, below the $582.1M analysts were expecting.

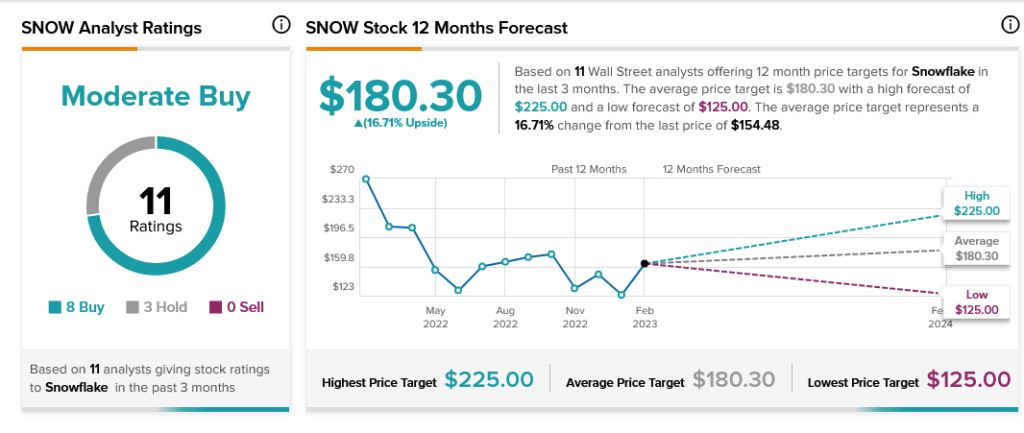

Overall, Wall Street has a consensus price target of $180.30 on Snowflake, implying 16.71% upside potential, as indicated by the graphic above.