Shares of Snap (NYSE:SNAP) soared 13% in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2023. Earnings per share came in at $0.02, which beat analysts’ consensus estimate of -$0.24 per share. Sales increased by 5.3% year-over-year, with revenue hitting $1.19 billion. This beat analysts’ expectations by $80 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Daily active users (DAUs) shot up to 406 million, growing by 12% compared to last year. Furthermore, the time spent on Spotlight more than tripled from the previous year.

Looking forward, management provided informal guidance due to the unpredictable nature of war. Nevertheless, it now expects revenue and adjusted EBITDA for Q4 2023 to be in the ranges of $1.32 billion to $1.375 billion and $65 million to $105 million, respectively. In addition, DAUs are expected to hit somewhere between 410 million and 412 million.

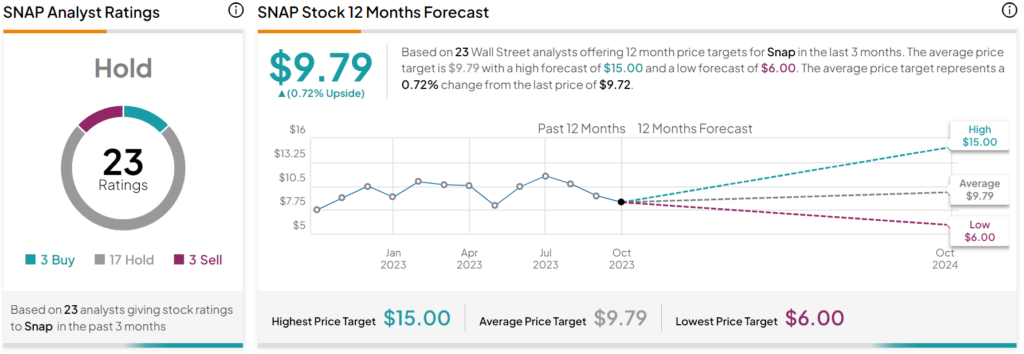

Is Snap a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Hold consensus rating on SNAP stock based on three Buys, 17 Holds, and three Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average SNAP price target of $9.79 per share implies 0.7% upside potential.