Shares of Snap (NASDAQ:SNAP) nosedived in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2023. Earnings per share came in at $0.01, which beat analysts’ consensus estimate of -$0.01 per share. Snap’s revenue hit $989 million. This missed analysts’ expectations of $1.01 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Snap’s reported global Daily Active Users (DAUs) figure came in at 383 million. That’s just under analyst projections calling for 384 million. Further, Snap also faltered in its average revenue per user (ARPU) figures, coming in at $2.58 against analyst projections of $2.63.

Snap didn’t offer official guidance for the second quarter. However, it did offer up “internal forecast” results that also disappointed against analyst projections. Snap looks for second-quarter revenue of $1.04 billion, but analysts expected $1.1 billion.

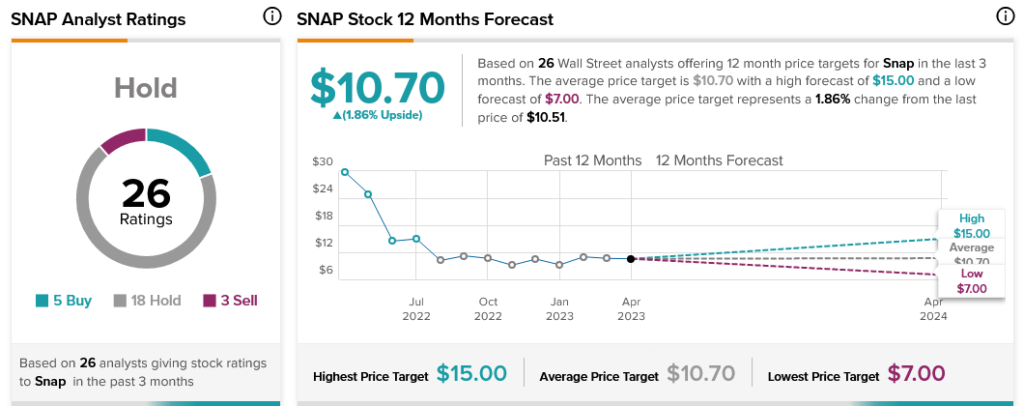

Overall, Wall Street has a consensus price target of $10.70 on Snap, implying 1.86% upside potential, as indicated by the graphic above.