While legacy automaker Nissan (NSANF) has been, somewhat, on the ropes lately, thanks to an ongoing transformation effort, there may be some signs of life stirring behind the scenes. One of the biggest of these is a new initiative that may let it take the fight to no less than Tesla (TSLA) when it comes to autonomous driving. The news gave shareholders a boost, and Nissan shares were up nearly 1.5% in Monday morning’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nissan has had its ProPilot system in place for quite some time now, and in terms of broad strokes, worked fairly well. ProPilot could handle large freeways fairly readily, but once it got down to the finer points—like crowded city streets—it tended to falter. However, new reports suggest that some refinements are under way and the next version will be able to close that gap, and using fewer cameras and monitors to do the job. Those improvements will start hitting cars in fiscal 2028, reports note.

General manager Tetsuya Iijima, with Nissan’s assisted-driving technology engineering department, noted, “We think ours is smarter than Tesla FSD, just not as polished a product.” This is actually saying something; while Japanese autonomous vehicle technology is a bit behind, reports note, Japanese regulation of autonomous driving systems is among the strongest on Earth. That, coupled with a range of demographic challenges facing the country, should make autonomous driving a major priority.

Ariya Out in United States

But Nissan is also making some tough choices. It recently announced plans to pare back its lineup in the United States, cutting out the Ariya electric SUV with the 2026 model year. Nissan will be rerouting those resources to focus on the Leaf and other, more “affordable” electric SUVs.

That actually makes a lot of sense. With the tax incentives gone, at least for now, electric vehicle makers will have to stand and fall on their own merits. Making affordable electric vehicles that work well is a lot more likely to get people’s interest than government-supported tax incentives.

Is Nissan Stock a Buy or Sell?

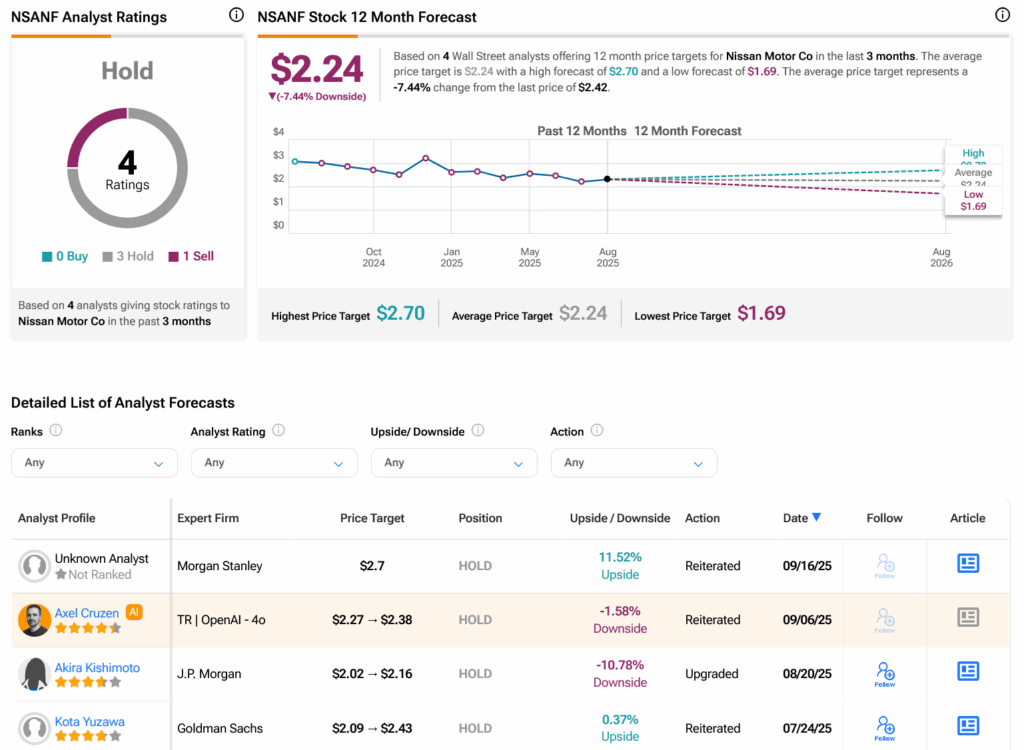

Turning to Wall Street, analysts have a Hold consensus rating on NSANF stock based on three Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 13.96% loss in its share price over the past year, the average NSANF price target of $2.24 per share implies 7.44% downside risk.