SLB (SLB), the Houston-based oilfield services giant previously known as Schlumberger, has made headlines for expanding its operations in Russia, despite the ongoing war in Ukraine and the exit of its major Western competitors. Texas-based SLB, formerly known as Schlumberger, has not only stayed put but has actually grown its presence in the country, signing new contracts and recruiting hundreds of staff.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Why Is SLB Staying Put?

While many Western companies have pulled out of Russia due to the conflict and international sanctions, SLB has chosen a different path. According to documents obtained by Global Witness and seen by the Financial Times, SLB signed a contract in December with the Russian oil and gas institute Vnigni, committing to help build models of oil and gas deposits for new projects. This move is seen by some as a way to gain a competitive edge, though not without controversy.

A Closer Look at SLB’s Expansion

The Financial Times reported that since December, SLB has posted over 1,000 job ads in Russia, seeking a wide range of roles from drivers to geologists. The benefits on offer are appealing, too, including lunch at work, access to sports facilities, and discounted share schemes. Additionally, SLB’s Russian subsidiaries registered two new trademarks in July, further signaling their commitment to the region.

SLB Continues Operations in Russia Despite Sanctions

In response to expanded international sanctions, SLB announced in July 2023 that it would halt shipments of products and technology into Russia from all its facilities worldwide. However, Russian customs filings show that the company continued to import equipment through other sources, bringing in $17.5 million worth of goods between August and December 2023. Most of these imports came from China and India, with some materials potentially subject to export controls if they were from the EU.

SLB Is Criticized by Human Rights Groups

SLB’s operations in Russia have drawn criticism from human rights groups and the Ukrainian government, who allege that the company’s work helps fund the Kremlin’s war efforts. Despite this, western policymakers have avoided imposing comprehensive sanctions on oilfield services in Russia, fearing that it could lead to a spike in global oil prices.

As Lela Stanley, a senior investigator for Global Witness, put it: “Western energy firms are still free to help Russia produce oil, and to help fund the war. That’s a profound failure.”

Looking Forward

SLB’s expansion in Russia, while its competitors withdraw, reflects a deliberate business strategy in a challenging and conflicted environment. Whether this bold move will pay off or backfire remains to be seen, but for now, SLB is doubling down on its presence in Russia, despite the risks and ethical concerns.

Is SLB a Good Stock to Buy?

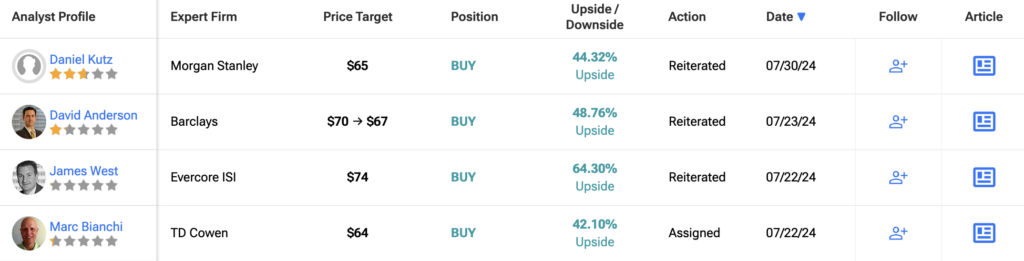

Analysts remain bullish about SLB stock, with a consensus Strong Buy rating based on 15 Buys and one Hold. Over the past year, SLB has decreased by 20%, and the average SLB price target of $66 implies an upside potential of 46.5% from current levels.