Archer Aviation (NASDAQ:ACHR) has become one of the market’s more intriguing high-flyers. The air taxi maker still hasn’t reported any revenue through Q2:25, yet its stock has rocketed 256% over the past year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As one of the early movers in the eVTOL space, Archer has been ramping up production at facilities in Georgia and California, kicked off its flight-test program in the UAE, and even secured the role of Official Air Taxi Provider for the Los Angeles Olympics.

Still, rapid progress hasn’t been cheap. Archer remains deep in the red and issued 85 million new shares earlier this year, a meaningful dilution for a company that now has roughly 645 million shares outstanding.

Yet, its financial footing is stronger than many emerging aviation peers. The company ended Q2, the last reported quarter, with a sizeable $1.7 billion cash reserve, giving it valuable runway to keep investing in development and certification.

That cushion has caught the eye of forward-looking investors who see short-term losses as the cost of building a new category of transportation – not a warning sign.

Enter top investor Rick Orford, who is leaning into the opportunity.

“Archer Aviation isn’t trying to disrupt cars or planes. They are building an entirely new category of transportation,” exclaims the 5-star investor, who ranks among the top 1% of stock pros on TipRanks.

Orford highlights Archer’s recent “power move” – acquiring Lilium’s IP portfolio for 18 million Euros after the German company filed for insolvency. Lilium spent more than $1.5 billion developing eVTOL technologies that now sit in Archer’s hands.

The investor argues that the deal could give Archer “an IP moat,” with Lilium’s ducted-fan tech serving as “a cornerstone of future designs.”

While Archer still awaits the “ultimate green light” of FAA certification, Orford notes that the company has already drawn serious institutional backing, including partnerships with the U.S. Air Force.

“Archer isn’t just chasing consumers, they are winning institutional trust from governments and defense contractors,” the investor adds.

The Lilium deal is another feather in Archer’s cap, and Orford believes that the company could very well be on its way to winning the eVTOL race in the years ahead. (To watch Orford’s track record, click here)

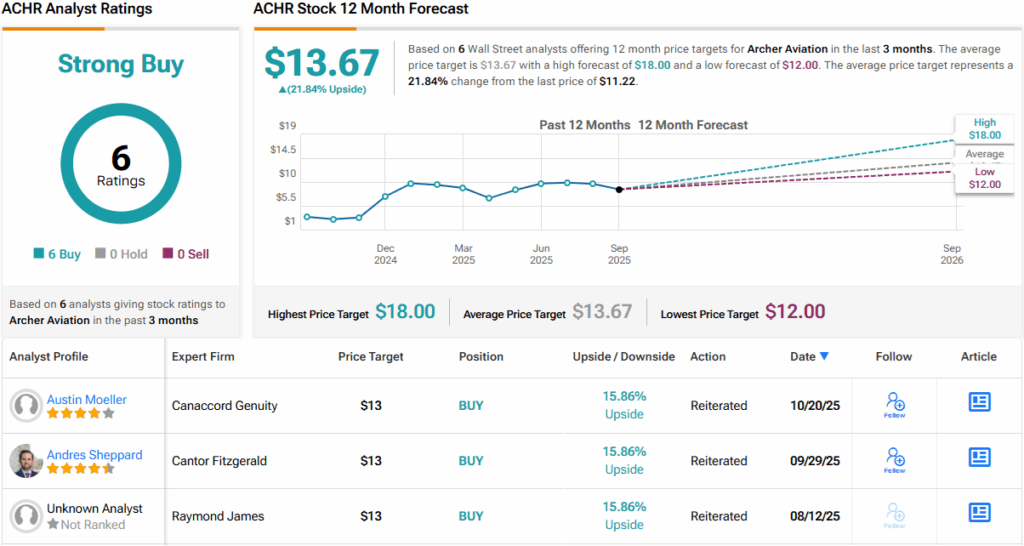

Wall Street shares that optimism. Over the past three months, analysts have issued 6 Buy ratings and no Holds or Sells, giving ACHR a unanimous Strong Buy rating. The average price target of $13.67 implies ~22% upside from current levels. (See ACHR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.