Plug Power and South Korean business group, SK Group on Jan. 6 announced a strategic partnership to offer hydrogen fuel cell systems to Korean and broader Asian markets. Shares of the hydrogen fuel cell solution provider jumped 27.4% in Wednesday’s extended market session after closing 7.5% higher at $35 on the day.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As part of the partnership, a US subsidiary of SK Group will invest $1.5 billion in Plug Power (PLUG) by acquiring 51.4 million shares at a price of $29.2893 per share. In return, SK will get a 9.9% stake in Plug Power.

Specifically, Plug Power and SK Group would provide hydrogen fuel cell systems, hydrogen fueling stations, and electrolyzers to the Asian markets.

“The current relationship with SK Group offers immediate strategic benefits to Plug Power to accelerate its expansion into Asian markets – and is intended to result in a formal joint venture (JV) by 2022. Due to the complementary strengths in this partnership, we expect rapid growth and significant revenue generation from the joint venture that are incremental to our 2024 plan,” said Plug Power CEO Andy Marsh.

The terms of the deal, which are subject closing conditions and regulatory approvals, are expected to close in Q121.

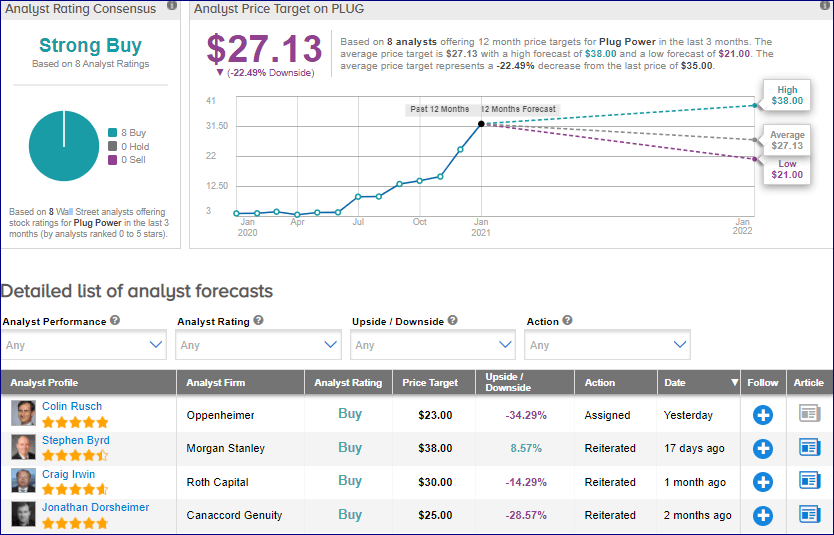

In reaction to SK Group’s investment in the company, Oppenheimer analyst Colin Rusch reiterated a Buy rating on PLUG stock with a price target of $23 (34.3% downside potential).

According to Rusch, the investment has incremental revenue growth potential of 40% or $500 million to PLUG’s 2024 revenue target of $1.25 billion.

The analyst believes that SK continues to be a clear leader in pioneering the adoption of hydrogen technologies in Korea with the Korean government targeting a $40 billion domestic hydrogen economy by 2040.

He expects the company to provide details regarding its progress on fuel cell vehicles, manufacturing and fuel capacity expansion, and select financial targets at its Jan. 21 corporate update. (See PLUG stock analysis on TipRanks)

From the rest of the Street, the stock scores an analyst consensus of a Strong Buy based on 8 unanimous Buys. The average analyst price target of $27.13 implies downside potential of 22.5% to current levels.

Related News:

Wednesday’s Market Snapshot: Here’s What You Need To Know Right Now

Procter & Gamble Pulls Out Of Billie Takeover Bid As Regulator Steps In

Fiat Chrysler’s US Sales Decline 8% In 4Q; Shares Drop 3.4%