The “halo effect” is alive and well. It’s an event that happens when one stock’s performance sympathetically drives up much of the market. Just ask Six Flags (NYSE:SIX). Its hefty double-digit jump lit a fire under competitors Cedar Fair (NYSE:FUN) and SeaWorld Entertainment (NYSE:SEAS). And it all comes down to one key asset that may be off its highs but is still pretty valuable: real estate.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Six Flags led the charge on the real-estate-induced gains after an activist investor, Land & Buildings Investment Management, suggested the company sell off its real estate. Analyst David Katz noted that the real estate making up Six Flags could be readily sold. Then, it could be leased back in 75% of Six Flags properties. However, Katz also noted that Six Flags had greater points to address. Among those was re-establishing trust among customers and employees alike.

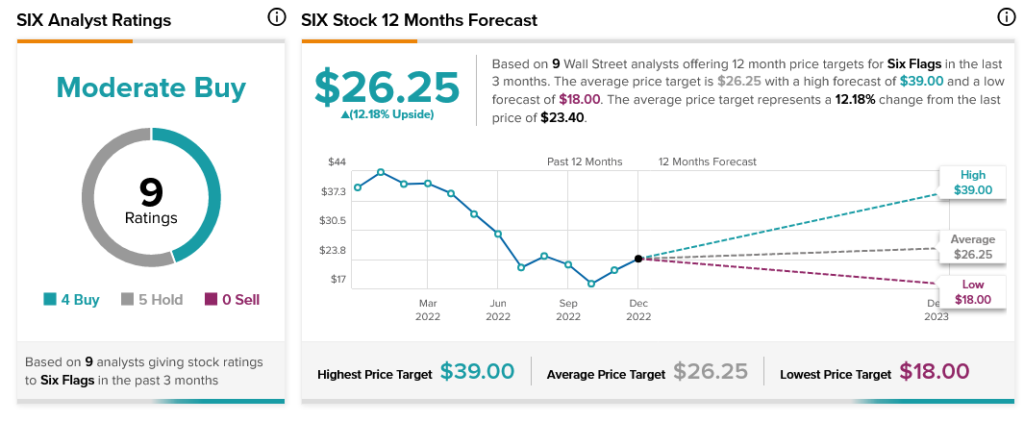

Further, reports suggest this isn’t the first time that Land & Buildings has made such a play. It does make some sense, however. The company owns 27 different attractions as of its last report. According to some reports, this represents enough land to potentially raise Six Flags’ share price as much as $11 per share just by engaging in a series of land deals. Such a move would not only put the company above its average price target but put it within striking range of its highest targets.

With analyst consensus somewhat split, such a move might be the bold stroke the company needs to recover. Currently, Six Flags is a Moderate Buy with one more Hold recommendation than Buys. The average price target sits at $26.25, which gives Six Flags 12.18% upside potential.