Sirius XM (NASDAQ:SIRI) might be one of the best replacement options for the car radio, thanks to its sheer range of music and spoken word content options. But that incredible range doesn’t extend to its workforce, as Sirius is dropping about 3% of its workers to improve operations. Investors were all right with this, sending shares up nearly 2.5% in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sirius let go of around 160 employees, a move that will make it “…more efficient, agile and flexible.” This comes after a move just last year—almost exactly—where Sirius ditched 8% of its workforce for the same reason. It also comes as part of a growing wave of layoffs in the tech sector, where about 34,250 employees have been let go. According to an internal memo, the move will also allow Sirius to “move faster” and “collaborate more effectively in support of our long-term objectives.”

But Then, They Did This

Sirius let 160 people go to fend for themselves, a move that will feel particularly annoying to both the let-go and the survivors alike in light of another move Sirius made. Sirius plans to drop $100 million—easily more than the annual salaries of those let go—to take on the SmartLess podcast run by “Arrested Development” alumni Jason Bateman and Will Arnett, along with Sean Hayes. To SmartLess‘ defense, though, it is one of the most popular podcasts on the face of the Earth, so it’s likely worth that kind of money to get it on Sirius XM. It’s easy to wonder how much of the firings was prompted by the sudden outlay of cash to get a podcast in the door.

Is SiriusXM a Buy or Sell?

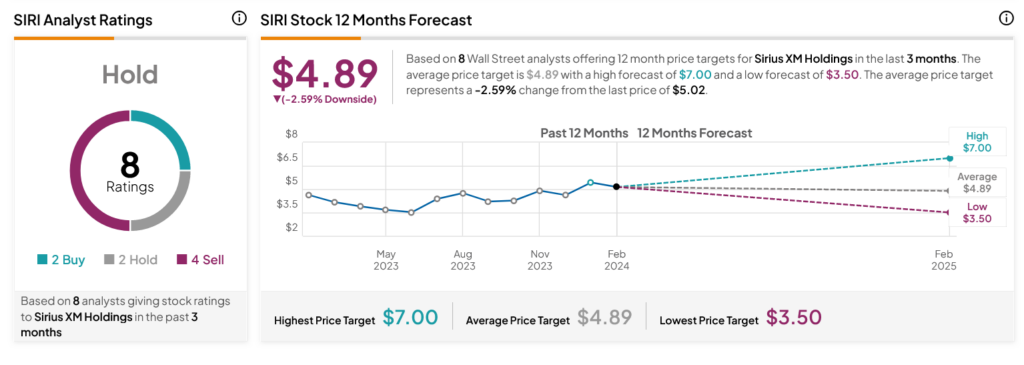

Turning to Wall Street, analysts have a Hold consensus rating on SIRI stock based on two Buys, two Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 60.01% rally in its share price over the past year, the average SIRI price target of $4.89 per share implies 2.59% downside risk.