Signet Jewelers Limited (SIG) posted strong results for the third quarter of fiscal 2021, registering a 13x growth in earnings per share. However, shares of the diamond jewelry retailer were down 5.2% to close at $88.17 on December 2.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Q3 Performance

Notably, adjusted earnings of $1.43 per share grew 13 times year-over-year, against $0.11 per share in the prior-year period.

(See Signet Jewelers stock charts on TipRanks)

Furthermore, revenues jumped 15.7% year-over-year to $1.5 billion compared to revenues of $1.3 billion in the year-ago period. The increase in revenues reflected an 18.9% spike in same-store sales, coupled with a growth of 14.4% and 20.3% in eCommerce sales and Brick and Mortar SSS, respectively.

See Analysts’ Top Stocks on TipRanks >>

Guidance

Management raised the financial guidance for fiscal 2022 based on the improved Connected Commerce capabilities, and business momentum witnessed during Black Friday and Cyber Monday weekend.

The company now forecasts total revenues in the range of $7.41 billion to $7.49 billion, higher than the previously guided range of $7.04 billion to $7.19 billion.

Similarly, same-store sales are expected to grow 41% to 43%, against the previously guided growth of 35% to 38%.

For the fiscal fourth quarter, revenues are projected to be in the range of $2.40 billion to $2.48 billion, and same-store sales are expected to grow 6% to 9%.

Furthermore, the company stated that it expects to close 75 stores in fiscal 2022 and open 85 stores in highly efficient Banter by Piercing Pagoda formats.

Management Weighs In

Signet CEO, Virginia C. Drosos, said, “While uncertainties remain in the macro environment, our strategies are working as evidenced by strong conversion rates and higher average transaction value. We have built a healthy operating structure enabling transformative investments that are attracting new customers and driving loyalty.”

She further added, “Our data driven customer insights and planning helped us secure earlier receipt of our holiday assortment and ensure no significant disruptions to our supply chain or labor needs.”

Wall Street’s Take

Following the Q3 results, Wells Fargo analyst Ike Boruchow maintained a Buy rating with a price target of $120 (36% upside potential) on Signet shares.

Boruchow believes that Signet shares should be bought on current share price weakness. He added that Signet continues to have strong momentum despite “overly conservative” guidance for Q4.

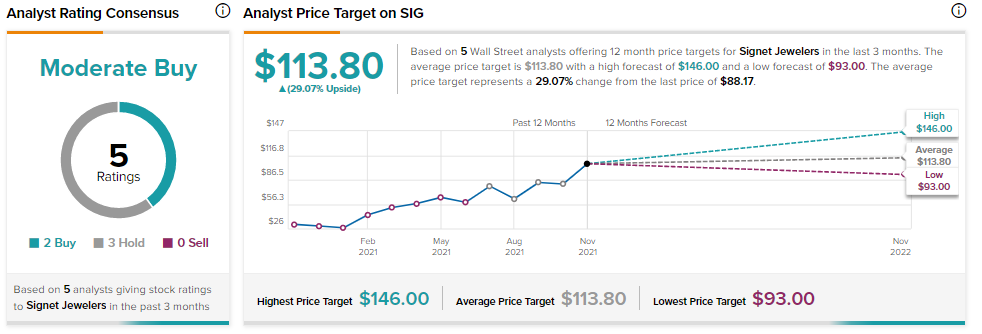

Overall, the stock has a Moderate Buy consensus rating based on 2 Buys and 3 Holds. The average Signet Jewelers price target of $113.80 implies 29.07% downside potential to current levels.

Related News:

Exxon Mobil Predicts Earnings and Cash Flows to Double by 2027

Accenture Acquires Headspring

Amphenol Corporation Acquires Halo Technology