Industrial giant Siemens Energy (OTHEROTC:SMEGF) recently turned in its earnings report, and it did not go well for the stock at all. However, its announced plans to reconsider its entire Wind division are leaving investors cheering, sufficiently so to send shares up nearly 7% in Wednesday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The numbers from Siemens’ fourth quarter were choppy, to say the least. It posted a loss of 870 million euros, which was down from a profit of 354 million euros in 2022’s fourth quarter. Revenue was also in open decline, down to 8.52 billion euros, a 2.5% drop against 2022. Orders dropped 7.8% as well, thanks mainly to an open decline in the Grid Technologies field.

A Glimmer of Hope?

With this substantial loss came reason for hope. Siemens made it clear that shoring up the balance sheet would be a major priority going forward, including a complete restructuring of the business. Potentially, some divesting of less-than-profitable divisions might follow. But what was much clearer was that Siemens got a boost from the German government. Several state guarantees emerged, adding up to a combined total of 7.5 billion euros, to help backstop the operation. It was part of a larger package of 15 billion euros, and was designed to ensure payments to secure customers. Siemens was quick to point out that this was, in fact, not “state aid.”

Is Siemens Energy Stock a Good Buy?

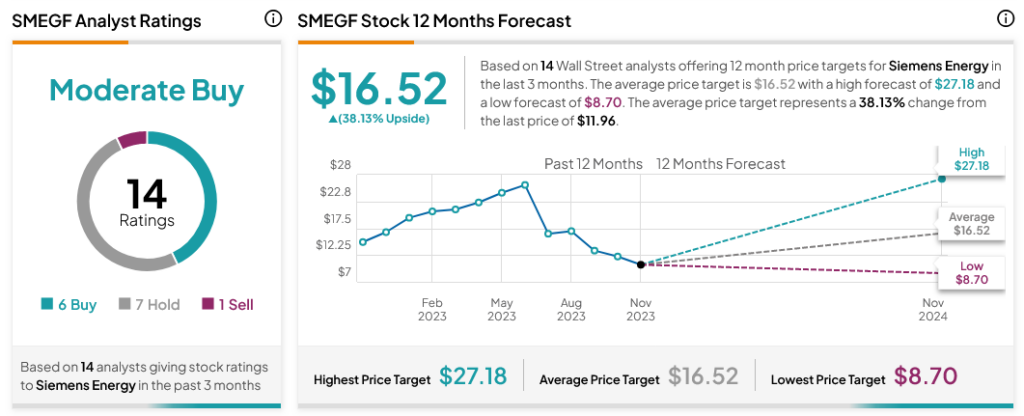

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SMEGF stock based on six Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 19.73% decline in its share price over the past year, the average SMEGF price target of $16.52 per share implies 38.13% upside potential.