Shares of financial solutions and services provider Silvergate Capital (NYSE:SI) are tanking in the pre-market session today after SI announced a business update and preliminary fourth-quarter numbers.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

SI noted that the digital asset industry is shifting to a “risk off” stance and consequently the company has seen total deposits from digital asset customers dwindle to $3.8 billion in Q4 (from $11.9 billion at the end of September 2022) and the company had to utilize wholesale funding to satiate the outflows.

The company is bracing itself for a period of transformation and is undertaking a number of steps. SI is now significantly trimming its headcount by about 40%.

Further, at the end of December, about $150 million of SI’s deposits were from customers who have filed for bankruptcy. The company had $4.6 billion in cash and cash equivalents at the end of this period.

To top it all off, SI is also taking a $196 million intangible asset impairment charge in Q4. The impairment is associated with technology assets SI acquired from the Diem Group.

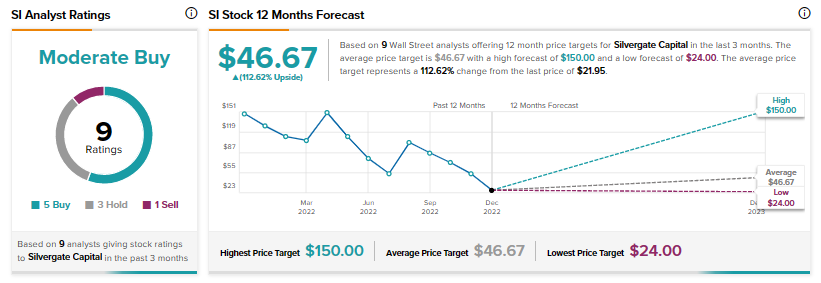

Analysts though, remain cautiously optimistic about SI with a Moderate Buy consensus rating and an average price target of $46.67. This points to a 112.62% potential upside in the stock.

SI shares have tanked a massive 85.43% over the past year and despite this steep fall, short interest in the stock still remains sky-high at about 54% at present.

The two major cryptocurrencies, Bitcoin (BTC-USD) and Ethereum (ETH-USD) have tanked 61.3% and 64.6% respectively over the past year. This fall has led to a change of fortunes for multiple names in the crypto space and more casualties could very well be in the making.

Read full Disclosure