Apple (NASDAQ:AAPL) is about to step up to report its September quarter earnings, and no company brings more championship credentials than the world’s most valuable. The tech giant will release its fiscal 4Q24 report next Thursday (October 31), and, as always, it is sure to capture Wall Street’s full attention.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Assessing the current situation, Bernstein analyst Toni Sacconaghi says the FQ4 data points have “come in relatively healthy, and currency has become an incremental tailwind.”

As a result, Sacconaghi has slightly raised his estimates, placing his revenue forecast for the quarter at $94.7 billion, an increase from his previous estimate of $93.7 billion and higher than the consensus of $94.2 billion. On the earnings front, the analyst projects EPS at $1.61, surpassing the Street’s forecast of $1.59 and aligning with Apple’s implied guidance of $1.55-$1.61.

However, Sacconaghi emphasizes that FQ4 results are historically less impactful compared to Apple’s outlook on the new iPhone cycle.

In this regard, Sacconaghi points out that early data for the iPhone 16 has been mixed. As a result, the analyst has lowered his FY25 estimates. Due to a “push out in Apple Intelligence availability and soft initial iPhone 16 data points,” Sacconaghi now expects FY25 revenue of $415.6 billion and EPS of $7.28, both below consensus at $421 billion and $7.47, respectively. The analyst expects iPhone revenues will increase by 5.6%, anticipating sales of ~246 million units (up 5.5%).

“Given the slow Apple Intelligence rollout, iPhone 16 cycle could be more backloaded and/or upgrades could be pushed out to next year,” Sacconaghi went on to say.

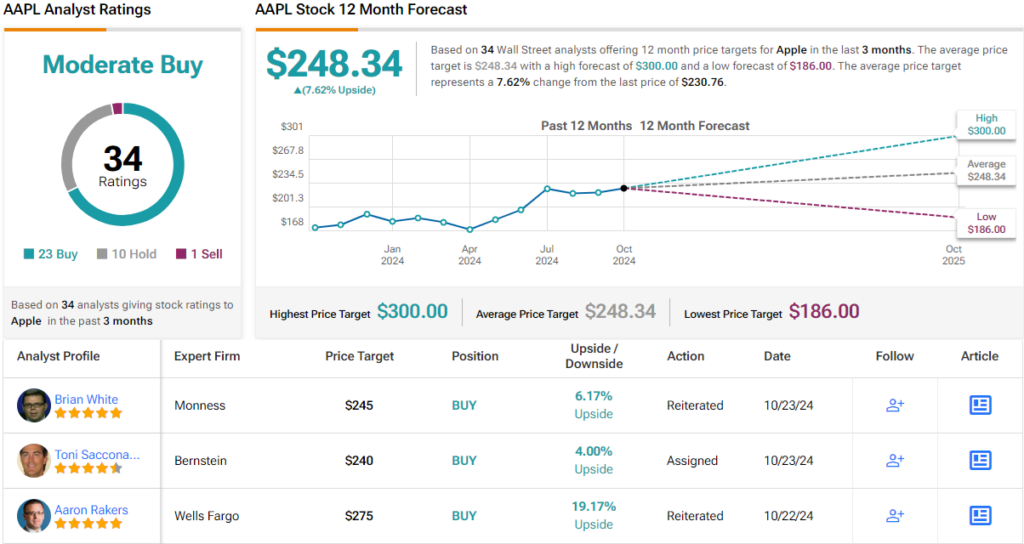

Bottom line, Sacconaghi rates Apple shares an Outperform (i.e., Buy) alongside a $240 price target, although that figure suggests the shares are currently fully valued. (To watch Sacconaghi’s track record, click here)

As for the broader analyst sentiment, of the 34 recent AAPL reviews, 23 recommend a Buy, 10 advise a Hold, and only 1 issues a Sell, resulting in a Moderate Buy consensus. The average price target stands at $248.34, implying shares will gain ~8% from current levels. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.