Based on practically every measure used to analyze publicly traded companies, car rental giant Hertz Global Holdings (HTZ) would be considered a gung-ho investment only suitable for traders with the most avaricious risk appetites. In the immediate timeframe, it doesn’t seem likely. On a year-to-date basis, HTZ stock is up 50%, while over the past 12 months, the security has gained more than 81%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

From that angle, Hertz has the appearance of a tech innovator just finding its mojo. However, nothing could be further from the truth.

Sure, Wall Street was initially stunned by Bill Ackman’s Pershing Square Capital Management disclosing a 19.8% stake in the struggling car rental giant. Many experts blasted the move because Hertz is weighed down by debt and prior missteps. Most importantly, it’s difficult to ignore the many other troubling financial metrics, including decelerating growth and last year’s net loss of $2.86 billion.

So, why even bring up such a high-risk idea? Simply put, HTZ stock could be the target of the next major short squeeze. Admittedly, this argument has circulated for some time, gaining momentum after Pershing’s investment became public. Still, the alarm bells are ringing loudly enough to merit a closer look.

Understanding the High-Risk Nature of HTZ Stock

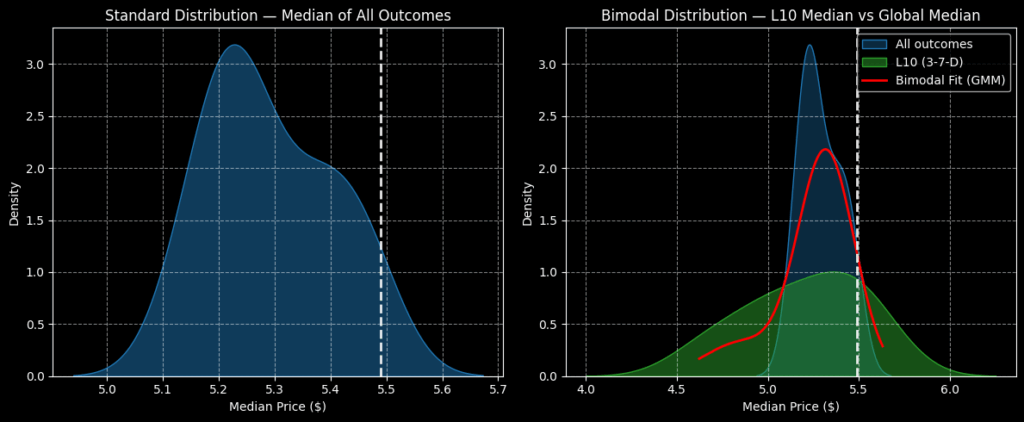

Before stepping into the world of Hertz, we must acknowledge the high-risk nature of the proposition. For typical blue-chip securities, the expected return over a given amount of time tends to approximate a normal distribution. This is the classic bell curve, where most outcomes are in the middle of the distribution, and relatively few outliers are on the extreme ends.

Obviously, HTZ stock is hardly what you would call a stable blue chip (at least not now). While its expected returns form a somewhat bell-shaped curve, it’s heavily skewed to the negative side of the spectrum. In other words, if you were to bet on HTZ stock today, over a certain length of time (in this particular case, 10 weeks out), the chances of you being unprofitable are incredibly high.

Of course, as various studies on market behaviors demonstrate, volatility tends to cluster rather than diffuse linearly and independently. Colloquially, how volatile today’s session is will largely depend on yesterday’s magnitude of volatility. Markets are psychological, responding to the immediate stimuli.

Using algorithms, we can isolate the behavioral probability of HTZ stock based on specific conditions. For example, in the trailing 10 weeks, HTZ printed a 3-7-D sequence: three up weeks, seven down weeks, with an overall negative trajectory.

Historically, though, when the market responds to this stimulus, the end result is often more volatility. What’s worse, you’re more likely under 3-7-D conditions to be unprofitable over the next 10 weeks than if you had simply bought HTZ stock at random. I mention all this to emphasize the fact that Hertz is a risky proposition indeed. Arguably, a gamble. According to my analysis, the stock is currently divorced from fundamental and mathematical reasoning.

Why Short Interest Matters

With so much that could go wrong, it raises the obvious question: why would anybody consider buying HTZ stock? It comes down to two words: short interest. And those two words lead to another pair: “short squeeze.”

Simply put, short interest represents the percentage of shares that have been loaned out for short-trading activities. A short transaction is the opposite of a long transaction. Rather than buying a security in the hopes that it rises, you sell borrowed shares hoping that they fall. If they do, you can then return the borrowed securities to the broker and pocket the rest as profit.

However, no matter what happens to the security, the lending broker must be made whole. So if the shorted stock rises, the bearish trader must buy back the shares at a higher price than it was sold for, absorbing a loss. And since there’s no upside ceiling, short traders run the theoretical risk of unlimited liability. The race to cut losses early before extreme damage sets in creates a positive feedback loop known as a short squeeze.

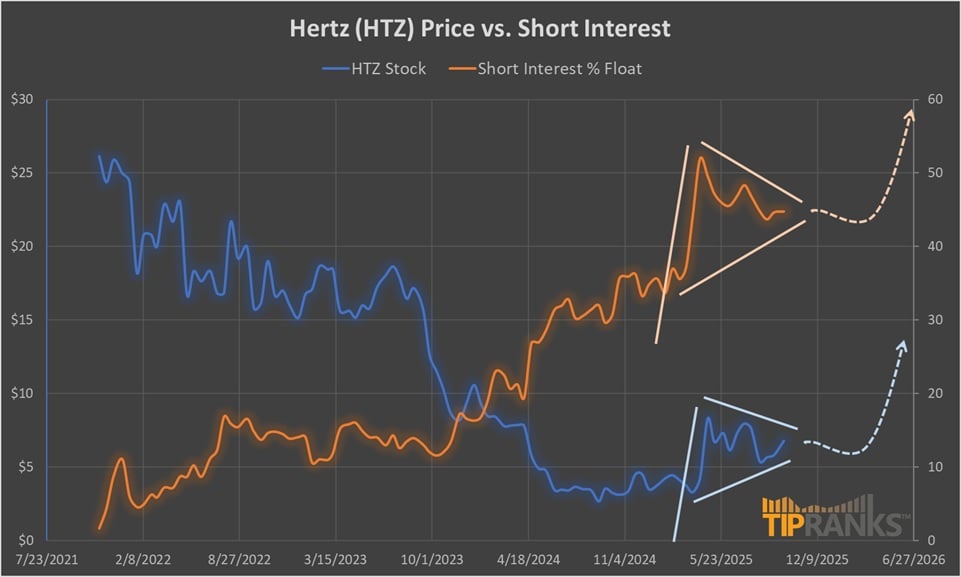

Notably, the short interest of HTZ stock stands at 45.16% of the float. Moreover, the short interest ratio clocks in at 6.95 days to cover, which means that it would take roughly a week-and-a-half in the business schedule to fully unwind this short exposure.

Also, both the HTZ stock price action and its short interest have formed a distinct triangle, which may indicate “coiled” sentiment, for lack of a better phrase. From a technical analysis perspective, when such compressions reach a critical point, the asset in question is liable to explode higher. Granted, it’s a heuristic, but I also don’t think the distinct pattern materializing is a coincidence, given the extremely high short interest.

Plus, if HTZ stock moves higher, it’s almost surely going to attract the bears, who are highly skeptical of the underlying company’s turnaround plans. Still, with the skepticism elevated almost to the breaking point, my opinion is that something’s going to give.

A Long View for Speculation

Since short squeezes can have their own psychology, it’s impossible to give specific trading ideas with any semblance of mathematical rigor or even emotional confidence. That said, there are two prudent approaches.

First, there is a case to be made for owning the stock outright. That way, you don’t have to worry about when the short squeeze might materialize. There’s nothing more frustrating in the options realm than getting the thesis right but the timing wrong.

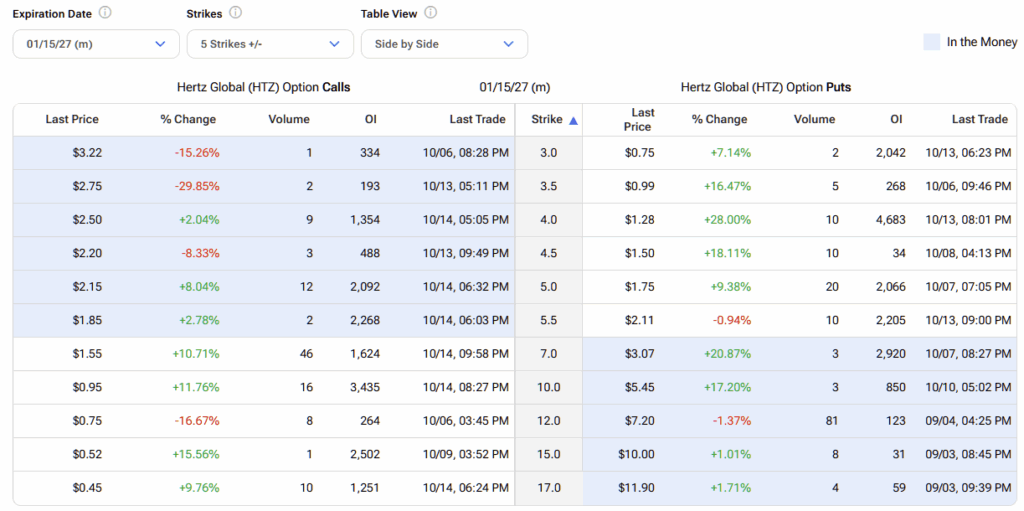

Second, if you’re dead set on utilizing leverage, then looking at buying out-of-the-money long-expiry calls could be interesting. Be warned, though, that you’re going to pay through the roof in terms of the bid-ask spread. For example, the $7 call expiring Jan. 15, 2027, carries a spread of almost 28%.

That’s steep, but that’s also the reality of HTZ stock options. You’re buying not to arbitrage pips here and there but to gamble on an unlikely turnaround.

Is HTZ Stock a Good Buy?

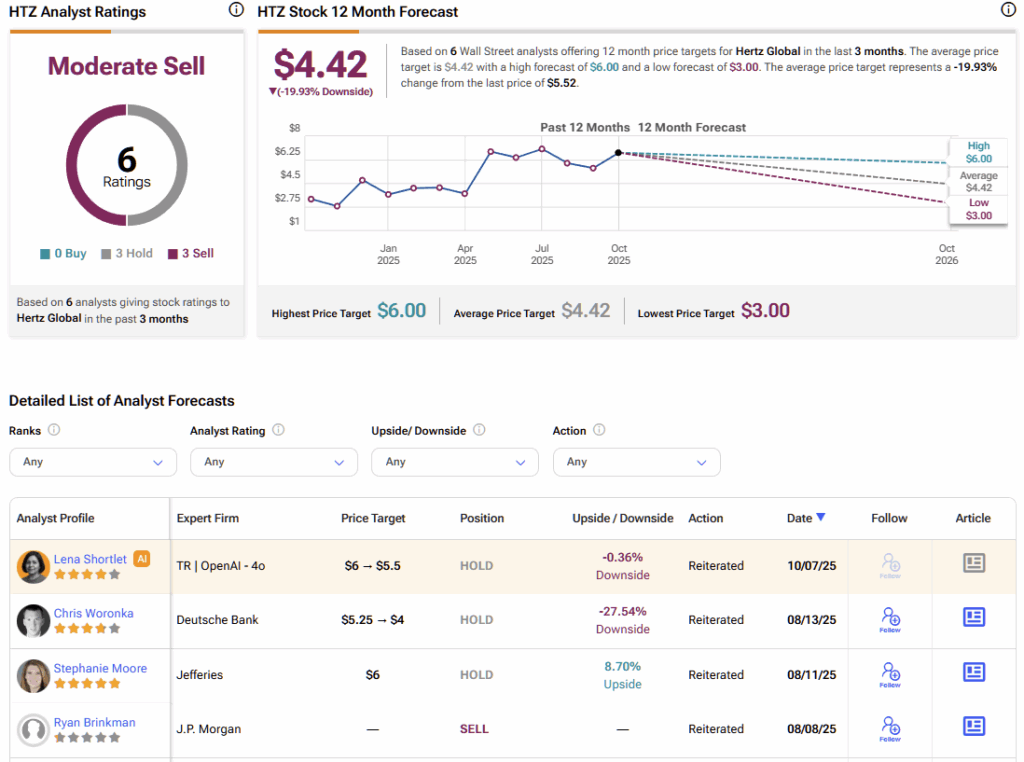

Turning to Wall Street, HTZ stock carries a Moderate Sell consensus rating based on zero Buys, three Holds, and three Sell ratings over the past three months. The average HTZ stock price target is $4.42, implying almost 20% downside risk over the coming year.

A Hertz Gamble with Herculean Potential Upside

While it can’t be stressed enough how speculative Hertz Global is, it’s also worth pointing out that hedge fund managers aren’t in the business of deliberately losing money. Plus, with short interest against HTZ stock skyrocketing, there’s very much a chance of a short squeeze erupting. If so, there won’t be too many people laughing at the potential upside.