Goldman Sachs analyst Gabriela Borges upgraded Shopify (NYSE:SHOP) (TSE:SHOP) stock to Buy from Hold and updated the price target to $74 from $67. The revised price target implies 26.1% upside potential from current levels. Borges believes that the pullback in SHOP stock creates a compelling entry point for investors seeking exposure to the retail software platform. Year-to-date, SHOP shares have lost 20.5%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shopify is a Canadian cloud-based global e-commerce platform for small and medium businesses. It hosts millions of merchants worldwide in more than 175 countries, supporting 10% of total U.S. e-commerce and contributing $444 billion in global economic activity.

A Glimpse of Shopify’s Q1 Performance

In Q1 FY24, Shopify reported an unexpected diluted loss of $0.21 per share on a reported basis, although adjusted earnings of $0.20 per share came in better than the consensus. Meanwhile, revenues rose 23.2% year-over-year to $1.86 billion and exceeded the consensus marginally. Also, its Gross Merchandise Volume (GMV) grew 22.8% year-over-year to $60.86 billion.

Finally, free cash flow (FCF) surged to $232 million, up 169.8% year-over-year, with FCF margin expanding to 12% from 6% in Q1 FY23.

Shopify has outpaced analysts’ earnings consensus in seven of the past eight quarters.

Borges Highlights Key Growth Catalysts for Shopify

Borges believes that one of the biggest catalysts for Shopify is the expected rise in revenue fueled by incremental marketing spend. He noted that most of Shopify’s marketing is tied to performance marketing, which has an average payback period of 18 months.

Moreover, Borges thinks that Shopify’s total addressable market (TAM) is expected to expand due to the growth in POS (point of sales), B2B e-commerce, and International businesses. The company has also undertaken several operational changes that are bound to improve cash flows in the long run.

Borges acknowledges that Shopify has always traded at a premium compared to its software peers historically. However, following the Q1 print, the analyst believes that the FCF projections support the higher valuation. The analyst has increased the FCF forecasts for Fiscal 2024 through 2026.

The analyst’s price target of $75 is based on 42x of its 2026 EV/FCF (enterprise value/free cash flow) estimate. Borges’ 2026 FCF estimate for Shopify ($1.75 per share) is 5% higher than the Street’s projection.

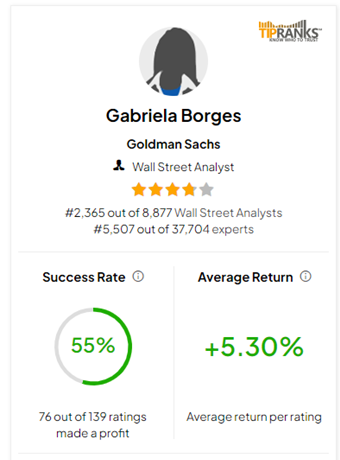

Borges’ Ranking on TipRanks

Gabriela Borges ranks 2,365 among more than 8,800 analysts on TipRanks. With a success rate of 55%, Borges has achieved an average return per rating of 5.30%.

Is SHOP Stock a Buy?

Not all analysts share the same enthusiasm as Borges on Shopify stock. On TipRanks, SHOP stock has a Moderate Buy consensus rating based on 16 Buys versus 13 Hold ratings. The average Shopify price target of $77.16 implies 31.5% upside potential from current levels.

Key Takeaways

Shopify reported better-than-projected results for the first quarter of Fiscal 2024. However, the Q2 guidance disappointed some investors and analysts. Having said that, Borges remains highly optimistic about Shopify’s growing FCF, TAM, and market penetration in the long run and considers the recent pullback in shares as a good entry point.