Canadian E-commerce firm Shopify, Inc. (NYSE: SHOP) (TSE:SHOP) has reported mixed results for the second quarter of 2022. The adjusted loss came in at $0.03 per share, compared to the profit of $0.22 per share in the previous year and the consensus EPS estimate of $0.02 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The reported figure includes a net unrealized loss of $1 billion versus a net unrealized gain of $800 million in the second quarter of 2021.

Total revenues grew 16% year-over-year to $1.3 billion. Monthly recurring revenue (MRR) rose 13% to $107.2 million, driven by an increase in the number of merchants joining Shopify’s platform and a rise in the number of retail locations using POS Pro.

Subscription Solutions revenue jumped 10% to $366.4 million, and Merchant Solutions revenue totaled $928.6 million, up 18%. The increase was primarily driven by an 11% rise in Gross Merchandise Volume (GMV) to around $47 billion.

The Ontario-based company ended the quarter with cash, cash equivalents, and marketable securities of $6.95 billion.

Shopify’s CFO Amy Shapero said, “While commerce through offline channels grew faster in Q2, where our exposure is lower but growing, we continued to see increased adoption of our solutions, enabling our merchants to remain agile against a challenging macro environment and highlighting the breadth and resilience of our business model.”

Revenue Outlook Looks Promising for the Second Half of 2022

For the second half of 2022, Shopify expects GMV to grow more than the broader retail market. A higher number of merchants are likely to join Shopify in the second half of the year versus the first half.

Further, the year-over-year revenue growth of the Merchant Solutions segment is expected to surpass the Subscription Solutions segment’s full-year 2022 revenue. The increase in Merchant Solutions revenue will be driven by Shopify Fulfillment, Shop Pay Installments, Shopify Markets, Shopify Capital, and Shopify Payments solutions.

SHOP Stock Has over 20% Upside Potential

Following the release of the results, Samad Samana of Jefferies (NYSE: JEF) assigned a Buy rating on the stock with a price target of $40 (32.3% upside potential).

Samana said, “Shopify has continued to strengthen its position as a platform for merchants to build on.”

Meanwhile, Kenneth Wong of Oppenheimer (NYSE: OPY) has reiterated a Buy rating on Shopify and lowered the price target to $45 from $50 (25.3% upside potential).

Wong said, “Shopify’s platform is best positioned to capitalize on the continued shift of consumer spend toward online and nuanced personalized channels.”

Overall, the stock has a Moderate Buy consensus rating based on 12 Buys, 15 Holds, and two Sells. SHOP’s average price target of $43.38 implies 20.8% upside potential.

Insiders & Hedge Funds Are Buying SHOP Stock

TipRanks’ Hedge Fund Trading Activity tool shows that the confidence in SHOP is currently Positive, as the cumulative change in holdings across all 36 hedge funds that were active in the last quarter was an increase of 1.3 million shares.

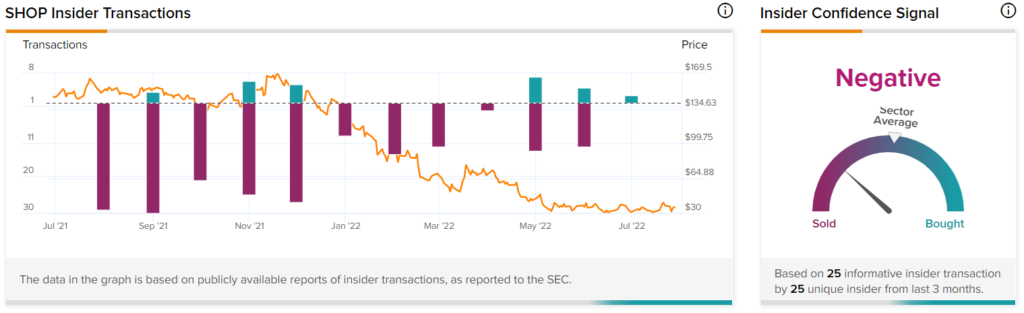

Additionally, TipRanks’ Insider Trading Activity tool shows that Insider Confidence Signal is currently Negative for Shopify, even though corporate insiders have bought SHOP stock worth $7.1 million in the last three months.

SHOP Stock Is in Demand

SHOP stock closed almost 2% higher on Thursday and was trading 1.1% up in the pre-market session on Friday, at the time of writing. This uptrend could be driven by the purchase of 1.77 million shares of the company by Catherine Wood’s ARK Investment Management LLC.

Read full Disclosure