Shopify (NYSE:SHOP) disclosed plans to lay off 20% of its workforce, or 2,000 employees, alongside its better-than-expected Q1 earnings release yesterday. Additionally, the e-commerce company is selling the majority of the assets of its logistics business to Flexport.

It is worth mentioning that this is Shopify’s second round of job cuts. In July 2022, it fired 10% of the total headcount, primarily from the recruiting, support, and sales teams.

With these restructuring moves, Shopify aims to concentrate on its e-commerce platform. The business believes that its platform needs to be updated with the newest AI-powered features.

Commenting on this development, Shopify CEO Tobi Lutke said, “But now we are at the dawn of the AI era and the new capabilities that are unlocked by that are unprecedented. Shopify has the privilege of being amongst the companies with the best chances of using AI to help our customers.”

Is Shopify a Buy, Sell, or Hold?

Since yesterday, the stock has received five Buy and five Hold ratings from Wall Street analysts. Among these, Goldman Sachs analyst Gabriela Borges believes that the shift in Shopify’s business strategy comes from several challenges Shopify has faced in scaling its fulfillment network effectively and the negative effects on profitability and cash flow.

The Street is cautiously optimistic about SHOP stock with a Moderate Buy consensus rating, based on 11 Buys and 19 Holds. The average price target of $50.88 implies 11.2% downside potential from current levels.

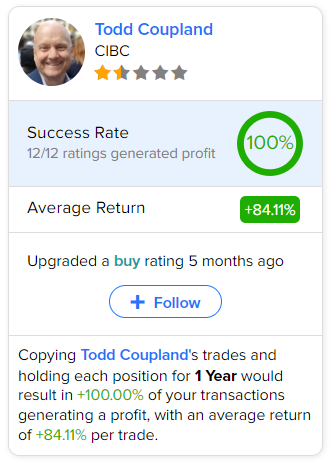

It is worth highlighting that analyst Todd Coupland of CIBC is the most accurate analyst in the case of SHOP stock. He has had a 100% success rate in his 12 ratings on Shopify. Importantly, replicating Coupland’s trades for a year would yield an average return of 84.11% per trade. Click on the image to learn more.