Shopify (SHOP) reported solid earnings for Q1 2025, but issued a more cautious profit forecast for the next quarter due to the effects of the ongoing U.S. trade war on its merchant customers. For the second quarter, the company projected a high-teen percentage growth for its gross profit dollars, below analysts’ expectation of a 20.2% increase. Meanwhile, Shopify expects revenue to grow in the mid-twenties percentage range in Q2, slightly above the analysts’ average estimate of 22.4% growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shopify Delivers Strong Q1 Numbers

In Q1, Shopify generated $2.36 billion in revenue, reflecting a 27% year-over-year growth, slightly exceeding its projections for the quarter. This marks the eighth consecutive quarter of revenue growth exceeding 25%, not counting the 2023 sale of Shopify’s logistics unit.

Additionally, Shopify’s gross profit climbed 22% year-over-year to $1.1 billion in Q1, exceeding its projected high-teens growth range. The company also reported $74.75 billion in gross merchandise volume (GMV), marking a 22% increase from Q1 2024. However, this came below analysts’ expectations of $76.09 billion.

Trade War Fears Loom over Shopify’s Growth Outlook

On the flip side, a more cautious outlook looms. Analysts warn that ongoing U.S.-China trade tensions and the recent elimination of the “de minimis” exemption could pressure Shopify’s small and mid-sized merchants. The exemption had previously allowed goods valued under $800 from China to enter the U.S. without duties. However, the benefit is now removed, potentially driving up costs for many of Shopify’s merchants and squeezing their profit margins.

Is SHOP a Good Stock to Buy?

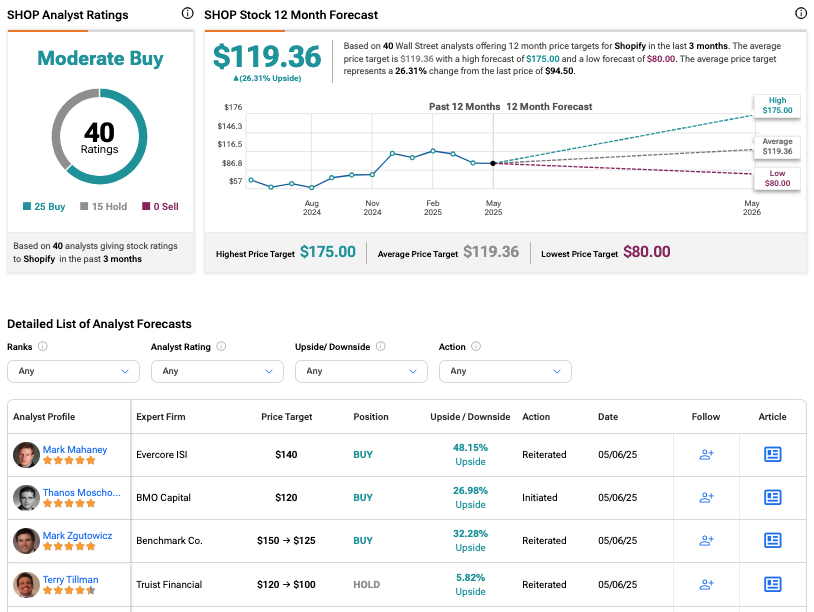

Overall, Wall Street has a Moderate Buy rating on SHOP stock, based on 25 Buys and 15 Holds assigned in the last three months. The average Shopify share price target is $119.36, which implies a 26.31% upside from the current levels.