Oil and gas major Shell’s (NYSE:SHEL) subsidiary Shell Petroleum N.V. is acquiring Nature Energy Biogas A/S in a $2 billion deal. The deal is expected to close in the first quarter of 2023. Nature Energy is Europe’s largest producer of renewable natural gas (RNG) or biomethane.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The deal is a step forward toward Shell’s goal of becoming a net-zero emissions energy business in the future. Shell eyes this deal as an opportunity to build the RNG business on a global scale. The company expects the demand for cleaner fuel to grow considerably in the future based on energy transition policies and customer preferences at present.

Further, the buyout is likely to expand Shell’s earnings growth and deliver “double-digit returns” on completion.

It is worth noting that about one-third of Nature Energy’s new plant projects are currently in the medium-to-late development stage. These projects are expected to increase production capacity to 9.2 million MMBtu/year by 2030.

Is Shell a Buy or Sell?

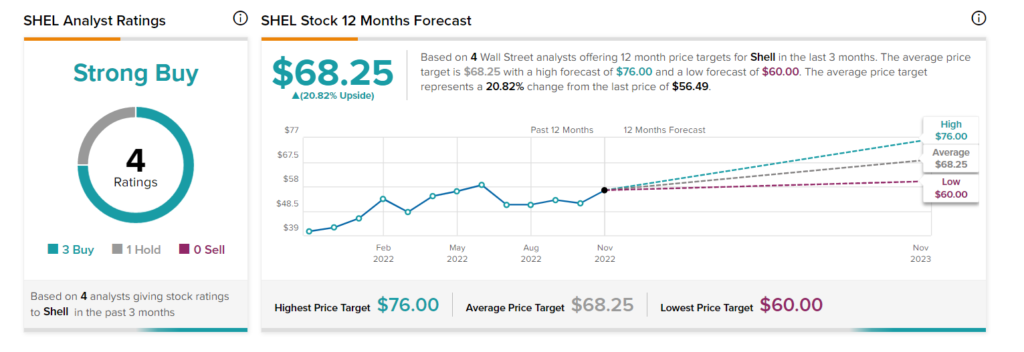

On TipRanks, the company has a Strong Buy consensus rating based on three Buys and one Hold. SHEL’s average price target of $68.25 suggests upside potential of 20.82%. So far this year, shares of Shell have increased by 31.2%.

Further, the company’s 3.32% dividend yield compares favorably with the sector’s average of 2.74%. It plans to increase the dividend per share by 15% for Q4. Also, supporting the bull case is SHEL stock’s beta of 0.20, as it suggests low exposure to the current market volatility.