Another quarter, another strong showing from Palantir (NASDAQ:PLTR). The big data analytics firm continues to impress, notching record revenue, expanding profits, and lifting its Rule of 40 score to an impressive 114. On paper, it’s hard to find much to complain about.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Yet, Palantir’s shares have slid by 14% since the earnings call. What’s behind the drop?

For one, sentiment toward the broader AI space has cooled a bit, with growing chatter about an AI bubble prompting investors to take profits across the tech sector. Adding fuel to the skepticism, Big Short Michael Burry disclosed a short position against Palantir.

But perhaps the biggest overhang is one that’s been around for a while: valuation. Even the company’s most enthusiastic supporters admit PLTR isn’t cheap. Investor Daniel Jones is among those who remain unconvinced that the current price is justified.

“Despite operational excellence and rapid growth in both commercial and government segments, PLTR remains extremely overvalued, trading at high multiples even under optimistic scenarios,” explains Jones.

Pretty much everyone agrees that Palantir as a business is going gangbusters, and Jones is no exception. The investor lists the “astounding” year-over-year revenue growth of 63%, the rapidly increasing number of commercial customers (which jumped from 498 to 742 in just one year), and rising full-year revenue guidance and adjusted income from operations.

And yet, despite the good tidings, Jones is convinced that Palantir spells trouble for investors. The investor is worried about the potential AI bubble, and he points out that many of the billions of dollars in spending are changing hands between just a handful of companies.

“Because of how incredibly expensive shares of the business are, any sort of sustained weakness in the AI market will prove disastrous for its share price,” Jones emphasizes.

The investor calculates that even in the rosiest scenarios through 2028, PLTR’s Price-to-Operating Cash Flow and EV-to-EBITDA multiples would still be 45.7x and 41.3x, respectively. Even though these multiples would be “more reasonable” than where PLTR is currently trading, Jones points out that it is tricky to project so far into the future.

“While Palantir Technologies has the potential to continue expanding nicely, the stock is drastically overpriced. And, according to that approach, at some point, shares must collapse,” sums up Jones.

No surprise here, Jones is reaffirming a Strong Sell rating for PLTR. (To watch Daniel Jones’ track record, click here)

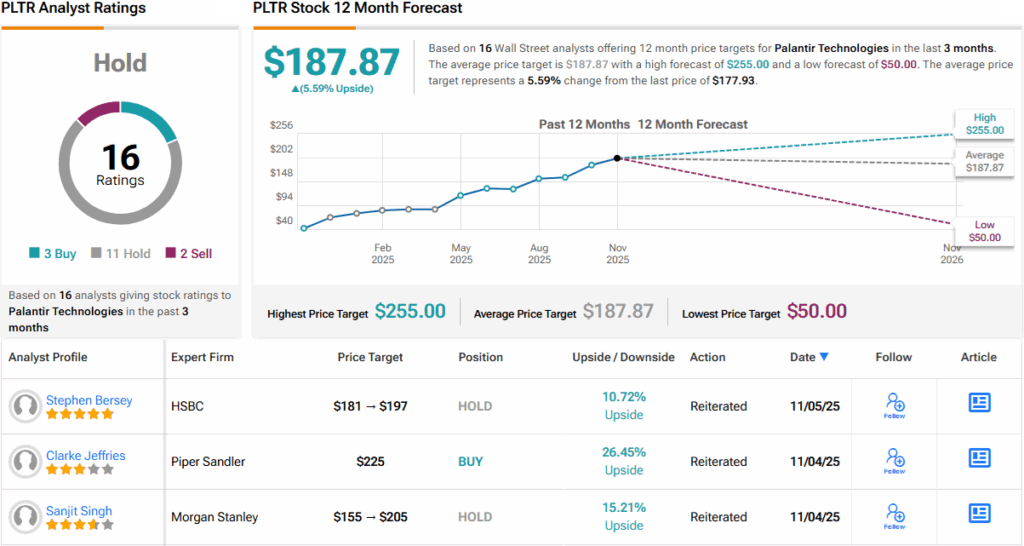

Wall Street, for its part, takes a more measured stance. Among 16 analysts tracked by TipRanks, 3 call it a Buy, 11 prefer to Hold, and 2 recommend Selling. On average, they see the stock reaching $18.87 over the next year – about 6% above where it trades today. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.