UnitedHealth Group (UNH) is facing pressure from a nonprofit shareholder advocacy group to separate the roles of CEO and Chairman of the Board, currently held by Stephen Hemsley, Bloomberg reported.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Hemsley previously served as UnitedHealth CEO for over a decade before becoming Executive Chair in 2017. He was reappointed as CEO in May to replace Andrew Witty, while retaining the Chair position.

The proposal, filed by the Accountability Board, argues that the company’s current leadership setup weakens accountability, especially now, when it is under higher scrutiny.

The group did not reveal its stake in UnitedHealth but stated that it meets the minimum ownership threshold required to submit a shareholder resolution.

“We think the company needs a stronger leadership structure,” said Matt Prescott, president of the Accountability Board, as reported by Bloomberg.

It is currently uncertain whether the Accountability Board’s resolution will meet the strict criteria necessary to be placed on the ballot for a shareholder vote at the next annual meeting.

UnitedHealth on a Recovery Path

UnitedHealth is currently making efforts to recover after a turbulent year. The company issued sharply reduced financial guidance in July.

It projects full-year adjusted earnings of $16.00 per share, down from a previous forecast of $29.50 to $30.00 per share. This drastic cut followed the suspension of its earlier outlook in May, primarily due to higher-than-expected medical costs.

Among the company’s recovery efforts, it plans to focus on implementing operational changes, adjusting pricing and benefits for its 2026 plans, and exiting some Medicare Advantage plans that serve unprofitable markets.

Recently, Hemsley noted that UNH is “positioning for growth in 2026 and beyond,” with a renewed focus on service quality and operational discipline. Also, the company’s Medicare Advantage star ratings suggest stability, which may help it secure higher government reimbursements and sustain long-term revenue growth.

Is UNH a Good Buy Right Now?

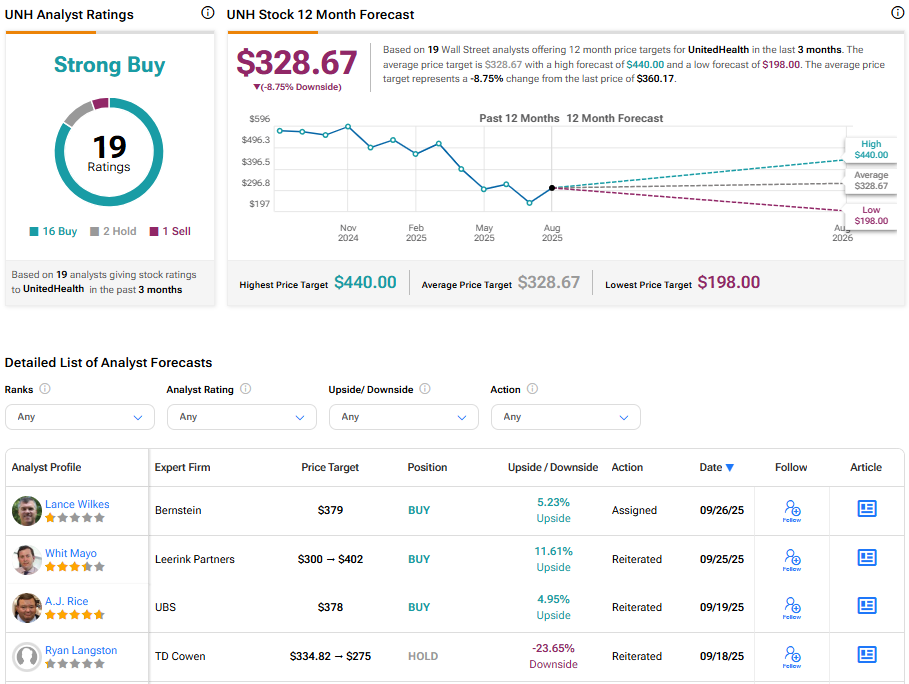

Turning to Wall Street, UNH stock has a Strong Buy consensus rating based on 16 Buys, two Holds, and one Sell assigned in the last three months. At $328.67, the average UnitedHealth stock price target implies an 8.75% downside potential.