“Shadow AI.” That is the term tech giant Microsoft (MSFT) uses for artificial intelligence (AI) tools that are used at work, without authorization. Whether it is a report or article generated by AI, or even an image done by same, the end result is the same: a huge potential risk that companies need to watch out for. Microsoft’s call for closer guard against shadow AI, particularly in the United Kingdom, hit hard. But investors largely shrugged it off, and sent Microsoft stock up fractionally in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Microsoft recently revealed that 71% of employers in the United Kingdom are seeing some level of “…unapproved consumer AI tools…” used at work. In fact, the report noted that 51% had seen such use every week. Around half of the respondents are using these tools to write workplace communications, while about 40% were using them for reports and presentations. Just shy of a quarter, 22%, were turning to AI tools for “finance-related tasks.”

Certainly there are benefits here. AI tools and assistants are producing about 12 billion hours’ worth of savings worldwide. With employees increasingly under the gun to produce, produce, produce, this makes a little AI fire support seem all the more worthwhile. But their unofficial nature, Microsoft notes, can represent potential problems, including potential security risks, that employees are either not aware of or simply do not care about as they work to produce, produce, produce to demands from above.

Yes, Virginia, There Will Be Another Xbox

Meanwhile, the future of Xbox seems a bit shaky, and not without reason. The ROG Ally is a compelling new feature in the field, but it has left many wondering if the days of a box in the living room are coming to an end. Not to worry, says Microsoft, which released a statement suggesting that the handheld will not be the only option.

From a recent statement: We are actively investing in our future first-party consoles and devices designed, engineered and built by Xbox. For more details, the community can revisit our agreement announcement with AMD (AMD)” This is a bit of a relief, of course, but the potential for a rug-pull does remain. And Microsoft’s comparative lack of transparency is leaving some users very concerned. At this point, little short of a full hardware reveal—which should be coming in the next year or two if standard console generation schemes hold true—will likely fully satisfy users.

Is Microsoft a Buy, Hold or Sell?

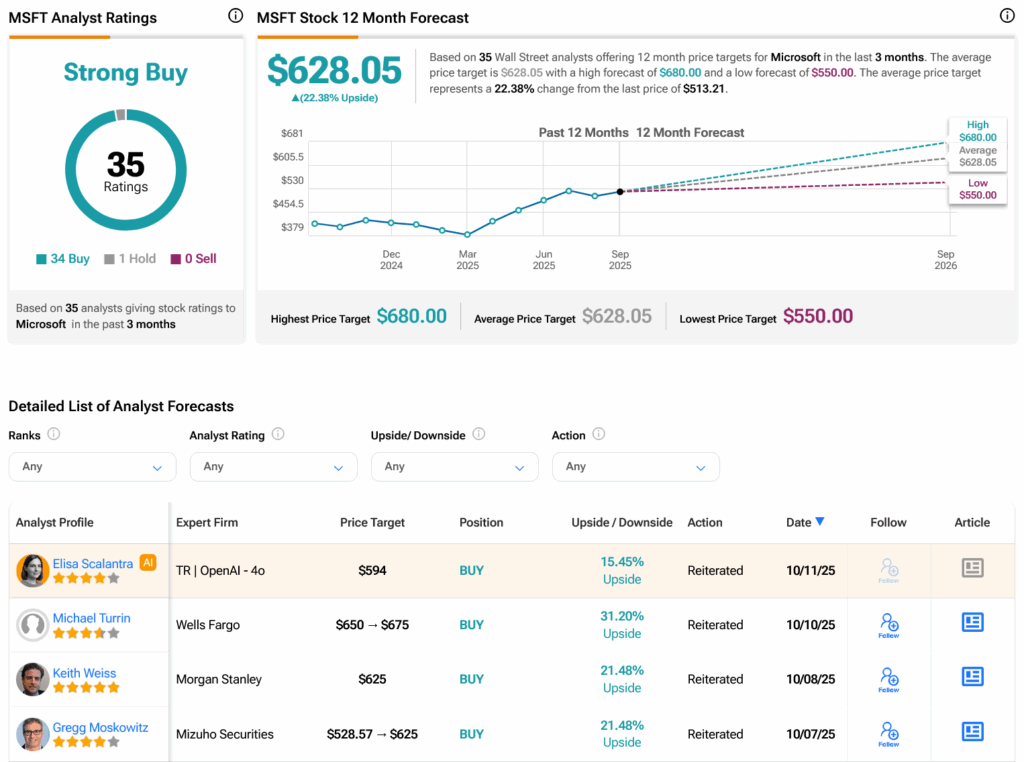

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 34 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 21.91% rally in its share price over the past year, the average MSFT price target of $628.05 per share implies 22.38% upside potential.