It’s been quite a month for winning streaks, and home improvement retailer Home Depot (NYSE:HD) is on track for a win of its own. With minutes left to Thursday’s trading session, Home Depot is on track to bring home its seventh straight winning trading session, up nearly 2.5% on the session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Home Depot shares are on track to clear a level not seen since February 2022, reports note, clearing $351.75 per share. Home Depot is up almost 11% on the year, and over the last six trading sessions, racked up nearly 5% extra in its overall market cap. All of November proved a winner for Home Depot, posting better than twice as many gaining sessions as declining, with 15 winning sessions against six losing sessions. Home Depot was something of a pandemic darling, back when people were undertaking home improvement projects when it became clear they’d be spending a lot more time therein than normal. While that’s no longer a factor, people are still improving their living spaces, possibly ahead of economic troubles that will serve the same function as lockdowns.

Fighting Back Against Shrink

While Home Depot is enjoying some spectacular gains of late, it’s having a much larger problem in a different area: shrink. Shrink, for those not familiar, is a retail term that refers to shoplifting or other theft from a retail store. In fact, Home Depot is taking its case to Congress, as its Vice President of Asset Protection Scott Glenn is pushing Congress to pass legislation to take on “organized retail crime groups,” who have been threatening Home Depot employees with a variety of physical assaults. Home Depot has gone so far as to employ off-duty police as security, but even there, it may not be enough.

Is Home Depot a Good Stock to Buy?

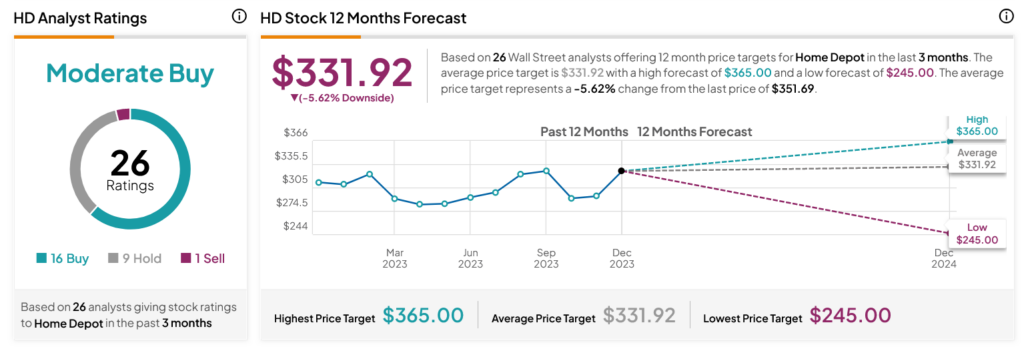

Turning to Wall Street, analysts have a Moderate Buy consensus rating on HD stock based on 16 Buys, nine Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 10.49% rally in its share price over the past year, the average HD price target of $331.92 per share implies 5.62% downside risk.