Shares of cloud software firm ServiceNow (NYSE: NOW) dipped in after-hours trading despite reporting Q2 earnings that exceeded expectations. It also announced multiple advancements in generative AI, one of them being a noteworthy collaboration with Nvidia (NASDAQ: NVDA). For the quarter ending June 30, ServiceNow pulled in an adjusted EPS of $2.37 on revenue of $2.15 billion, with subscription earnings standing at $2.075 billion, a 25% YoY rise. For reference, analysts were expecting EPS of $2.05 and revenue of $2.129 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

ServiceNow also announced AI Lighthouse, an AI-centric project in partnership with Nvidia and Accenture, aimed at expediting the development and deployment of generative AI capabilities. Going forward, the company expects subscription revenues for Q3 to range between $2.19 billion to $2.2 billion, surpassing the estimated $2.15 billion. For the full year, ServiceNow anticipates subscription earnings to be in the ballpark of $8.58 billion to $8.6 billion, beating the estimated $8.51 billion.

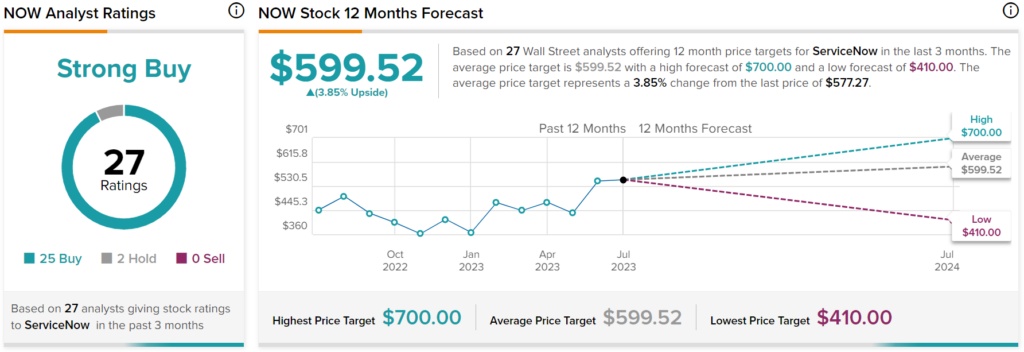

Turning to Wall Street, analysts have a Strong Buy consensus rating on NOW stock based on 25 Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $599.52 per share implies only 3.85% upside potential.