The end of the year is in sight, and we’re gearing up for the final sprint to the finish of 2025 – making this the perfect time to seek out stocks that can deliver solid returns through the holiday season and into 2026. Savvy investors build diversified portfolios, balancing risk and reward with value and growth, while supplementing them with reliable passive income streams.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Passive income is a classic play for investors seeking steady returns, and the traditional way to achieve it is by investing in dividend stocks. While a dividend-heavy strategy is usually considered defensive in nature, dividend stocks can face the same headwinds and volatility that buffet markets in general – but they’ll still pay out dividends, and that will always have a salutary effect on total returns.

The best dividend stocks typically offer one of two key attributes – a strong yield, well above the prevailing rate of inflation, or a reliable payment history stretching back several years. Both are clear indicators of a strong dividend, and right now, we’ve opened up the TipRanks database to look at two such stocks offering high-yield payments – as high as 12% in one case.

But there’s more to these picks than just juicy payouts. Each carries a Strong Buy consensus from Wall Street’s analysts, reflecting confidence that stretches beyond income potential alone. Let’s dive in and see what makes these high-yield dividend plays worth buying.

Mach Natural Resources (MNR)

We’ll start with Mach Natural Resources, a firm that defines itself as an independent company focused on the upstream oil and gas market, working on the acquisition, development, and exploitation of hydrocarbon reserves. Put more specifically, Mach aims at exploration and production of crude oil, natural gas, and natural gas liquids, primarily in the Anadarko Basin, a geological formation that spreads across western Oklahoma, southern Kansas, and the Texas Panhandle.

Mach’s strategy is based on seeking out and acquiring the best holdings for exploration and development. The company optimizes its production through efficient drilling activities in its existing inventory as a hedge against risk. As a further hedge, the company is beginning to expand its operations outside of the Anadarko Basin. In July of this year, Mach announced that it was making a transformative acquisition in the Permian and San Juan Basins, and on September 16 announced that the acquisition had closed.

The new holdings include oil and gas assets acquired from Sabinal Energy, along with a number of entities owning oil and gas assets managed by IKAV Energy. The total purchase price for these assets came to $1.3 billion and was conducted in cash and stock – and in the Permian, it gives Mach a foothold in one of North America’s richest oil and gas basins.

This oil and gas operator went public in October of 2023 and has been paying out dividends since the first quarter of 2024. The firm’s most recent dividend declaration was made on August 7, in conjunction with the 2Q25 earnings release, and set the payment at 38 cents per common share. At that rate, the dividend annualizes to $1.52 per common share and gives a forward yield of 12.5%.

Strong financial performance has supported those payouts. In the second quarter, the last reported, Mach generated $289 million in revenue, topping estimates by more than $50 million, and reported $45.98 million in cash available for distribution, directly underpinning its dividend strength.

Still, investors have shown some hesitation. Mach’s shares have fallen 29% this year, reflecting concerns about execution risk and leverage following the $1.3 billion acquisition, as well as pressure from softer natural gas prices.

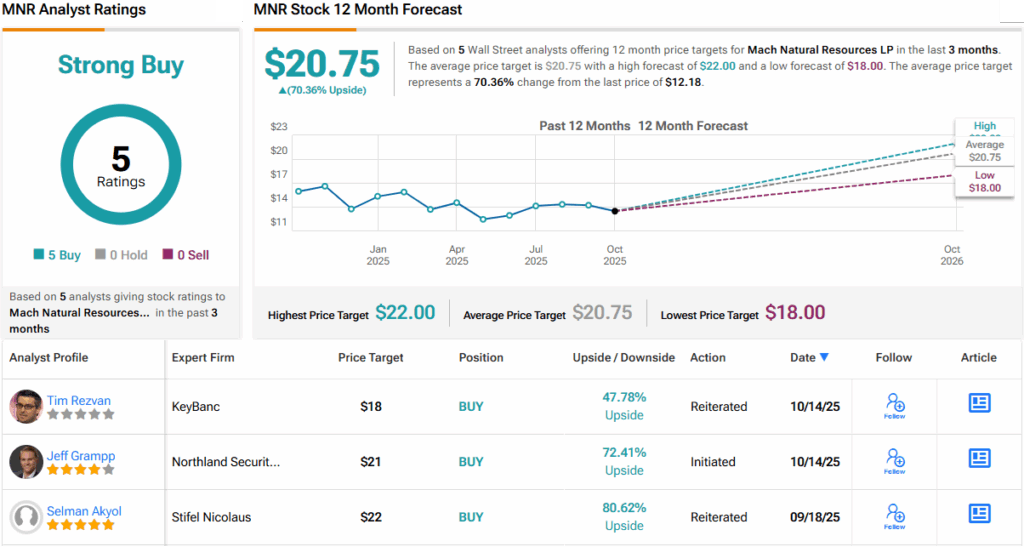

Even so, Northland analyst Jeff Grampp considers the recent decline a ‘buy the dip’ opportunity, citing Mach’s robust dividend and appealing valuation as reasons for optimism.

“We like MNR’s high distribution strategy, which provides robust quarterly distributions to shareholders. Since inception in 2017, MNR has distributed $1.2 billion to its members (through 9/4/25) and the Company has a current yield of ~12% (most recent quarter annualized). Additionally, we estimate a yield over the next four quarters of ~14%. We believe these kinds of distributions are sustainable given the Company’s lower leverage, modest reinvestment rates and track record of disciplined and accretive M&A,” Grampp opined.

The analyst goes on to lay out a case for buying in, adding, “MNR currently trades at 4.1x EV/EBITDA (’26) and a 14.6% CAD yield (’26) at benchmark prices of $62.50/$4.00. We believe this is an attractively low valuation for a company with a high return of capital model that helps de-risk investor returns, coupled with a solid balance sheet and lower reinvestment requirements.”

Taken together, these comments back up Grampp’s Outperform (i.e., Buy) rating on the stock, while his $21 price target points toward a one-year upside potential of 72%. Add in the dividend yield, and this stock’s one-year return could exceed 84%. (To watch Grampp’s track record, click here)

The Strong Buy consensus rating on MNR stock is unanimous, based on 5 uniformly positive analyst reviews. The stock is currently trading at $12.18, and its average target price, now at $20.75, implies a 70% gain in store for the year ahead. (See MNR stock forecast)

Kinetik (KNTK)

The next dividend stock we’re looking at is another energy company – this one focused on midstream operations in the Delaware Basin, an important part of the larger Permian formation in Texas. The Permian, as noted above, is one of North America’s richest hydrocarbon-producing regions. Kinetik’s activities there include gathering, stabilization, and transmission services for crude oil, natural gas, natural gas liquids, and produced water.

Drilling down, we find that Kinetik’s oil services, which include gathering, stabilization, and storage in the Delaware, are based on 200 miles worth of in-service pipelines and 90,000 barrels worth of crude oil storage capacity. On the natural gas side, Kinetik has an interconnected processing capacity of 2.2 Bcf per day and supports approximately 3,500 miles of low- and high-pressure steel pipelines. The company also has some 360 miles of produced water gathering pipelines and boasts 760,000 barrels per day of permitted injection capacity.

In addition to these activities, Kinetik is also a joint venture partner in three strategic pipelines that transport product from the Permian to the Texas Gulf Coast. The Gulf Coast is well known as a major center for hydrocarbon resource demand and is home to a dense network of storage, import-export, processing, and transport facilities for oil and gas products.

In its last reported quarter, 2Q25, Kinetik generated $426.7 million in total revenues, a total that was up 18% year-over-year and beat the estimates by $32.3 million. The company’s bottom line came to $0.33 per share, by GAAP measures; this was down from the 54-cent EPS reported in the prior-year period but beat the forecast by 12 cents per share. The company’s distributable cash flow of $153.3 million provided full coverage of the dividend, which was last declared on October 15 for 78 cents per common share.

At the declared rate, the dividend annualizes to $3.12 per share and gives a forward yield of 7.7%. The dividend is scheduled for payment on October 31.

Even with solid infrastructure growth in the Permian Basin, investor sentiment has soured amid worries about an elevated valuation, softer commodity prices, and doubts over whether the company can meet its lofty earnings expectations, sending the shares down about 29% year-to-date.

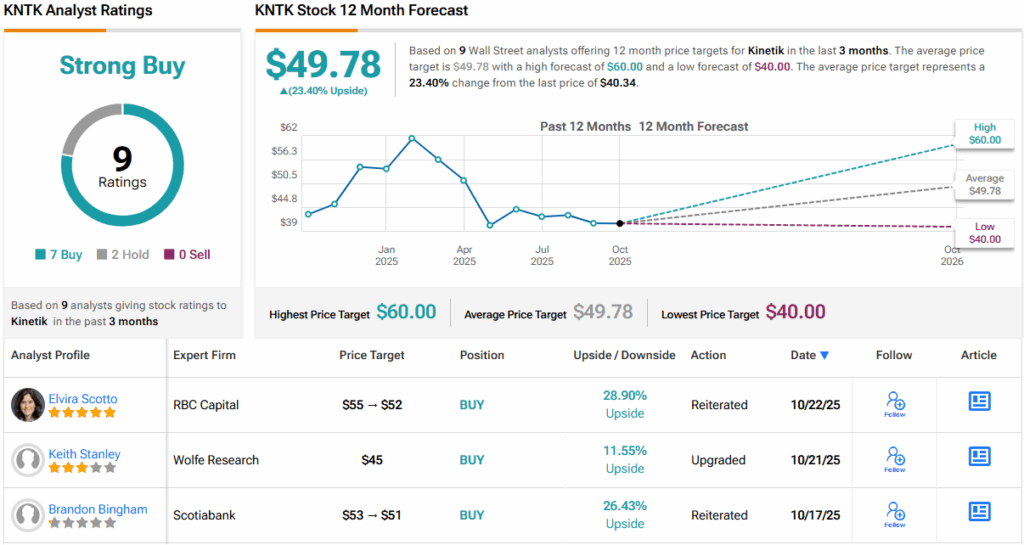

According to Wolfe’s Keith Stanley, however, the current weakness could represent an opportunity. The analyst argues that at these levels, investors get a “free option” on growth and potential takeout, suggesting now may be the right moment to act.

“2025 has been a challenging year with operational hiccups and lower commodity prices. While another guidance cut is possible with Q3 earnings, we think it’s already baked in after the recent sell-off. We see valuation as attractive with KNTK at a record discount to C-corp peers and even a slight discount to the MLPs. We see significant upside if KNTK even comes close to hitting the 10%/yr EBITDA growth target through 2029, but limited downside given 8.5% yield support tied to a relatively low payout ratio of ~60% of OCF in 2026,” Stanley noted.

Looking ahead, the analyst lays out several reasons why investors should buy now: “Aside from valuation having come in significantly, a worsening overbuild situation in the Permian NGL value chain post TRGP’s Speedway FID increases the value of KNTK to larger players. We strongly believe Permian NGL players have a big incentive to secure NGL volumes to feed underutilized pipes and export facilities, while also attempting to preserve margins through the value chain. KNTK is the only large Permian pure play G&P left to pursue with significant NGLs from its plants up for grabs in the coming years.”

Stanley quantifies his positive stance with an Outperform (i.e., Buy) rating and a $45 price target that implies an 11.5% upside on the one-year horizon. The potential share price gain plus the dividend yield add up to a return of nearly 19% by this time next year. (To watch Stanley’s track record, click here)

All in all, the 9 recent analyst reviews here include 7 Buys and 2 Holds, for a Strong Buy consensus rating. KNTK’s $40.34 trading price and $49.78 average target price together suggest a 23% upside for the stock over the next 12 months. (See KNTK stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.