As 2025 draws to a close, Wall Street analysts are turning their attention to income-generating stocks that can deliver meaningful returns in the year ahead. This naturally has some of them focusing on dividend payers – a core component of any diversified, return-oriented portfolio.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Dividend stocks, especially those offering elevated yields, appeal to investors seeking both steady income and potential upside. While some companies boast a track record of dependable payments, others attract attention for their higher payouts that compensate for greater risk – a balance that many yield-hungry investors are willing to consider.

The most compelling dividend opportunities often combine attractive yields with either consistent history or improving fundamentals that suggest the payouts can be sustained. These are the traits analysts are watching closely as they identify income plays poised to stand out in 2026.

Against this backdrop, we’ve used the TipRanks database to get a closer look at two names that the pros say are dividend stocks worth buying. Each offers a solid yield, reaching as high as 10% in one case. Let’s give them a closer look.

Apollo Commercial Real Estate (ARI)

We’ll start in the world of real estate investment trusts, or REITs. Apollo Commercial Real Estate, which operates in the US and Europe, mainly originates and invests in a variety of real estate-related instruments. These include senior mortgages, mezzanine loans, and a variety of collateralized commercial real estate debt investments. Apollo Commercial Real Estate is an externally managed company; the external manager, ACREFI Management, LLC, is an indirect subsidiary of a major global alternative investment management company, Apollo Global Management. The REIT is able to tap into the private equity, credit, and real estate assets of the investment manager.

When we take a closer look at Apollo Commercial Real Estate’s business, we find that the company had, as of September 30 this year, a commercial real estate loan portfolio worth $8.3 billion, spread across 54 loans. Nearly all of them, 98%, are floating-rate, and the same proportion are first-mortgage loans, underscoring the firm’s focus on senior positions in its lending strategy. The portfolio carries a weighted-average remaining fully extended term of about three years.

Drilling down a bit, we find that, geographically, the largest segments of the company’s portfolio are located in the UK (31%) and New York City (17%). The company also has investments in mainland Europe, and in the American Southeast, Midwest, and West. By use, 31% of the portfolio is residential, 25% is office space, and 17% is hotels. The company’s reach also extends to industrial and mixed-use properties.

Apollo Commercial Real Estate’s work supports the company’s dividend, which it has been paying out since 2010. The company has made occasional adjustments to the dividend rate in order to keep the payment sustainable; the dividend is currently set, per the September 9 declaration, at 25 cents per common share. This dividend was last paid out on October 15, and the $1 annualized rate gives a yield of 10%.

Looking at the earnings that back up this REIT’s dividend, we find that Apollo reported total revenues of $61.62 million for the third quarter, down 14% year over year. On the bottom line, distributable earnings per common share – the metric that directly supports the dividend – came in at $0.30, topping the consensus forecast by $0.05.

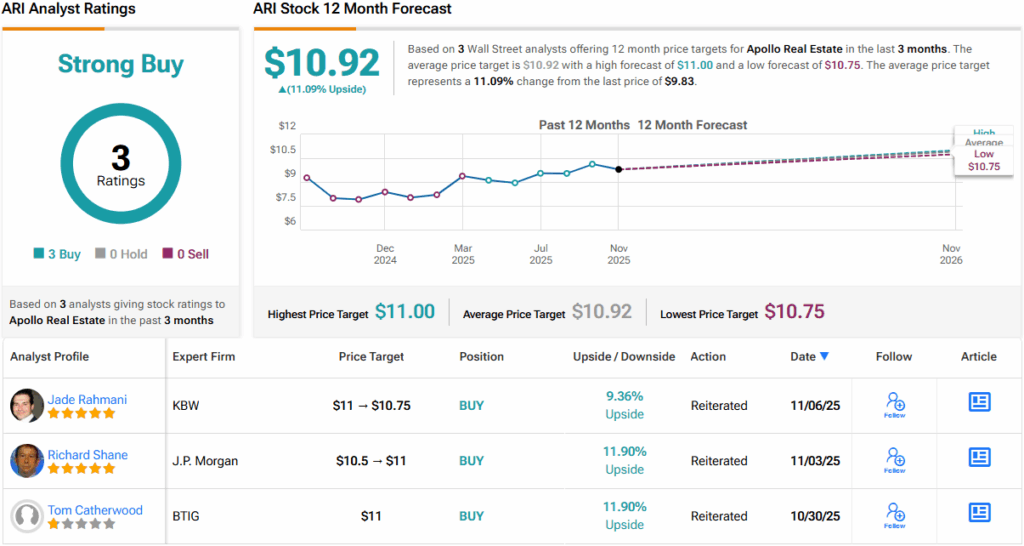

Encouraged by these results, J.P. Morgan’s Richard Shane, a 5-star analyst on the sector, believes the company has a sound future ahead of it.

“ARI beat our estimates due to lower than projected provision expense and zero realized losses in 3Q. We further note that the strength in condo sales at 111 West 57th (6 sales in 3Q and 4QTD) is a potential catalyst for capital redeployment and DEPS accretion… We believe ARI fits well within our current framework for CREITs. The company has made progress resolving troubled loans, and we believe it is well positioned to redeploy capital into interest earning assets. As the company’s portfolio returns to growth mode, it creates a setup for higher NII and greater earnings potential, by our estimates,” Shane noted.

Shane backs up his positive view with an Overweight (i.e., Buy) rating on ARI and a $10.92 price target, suggesting potential upside of about ~12% over the next year. Based on the current dividend yield and the expected price appreciation, the stock has ~22% potential total return profile. (To watch Shane’s track record, click here)

Overall, there are 3 recent analyst reviews on file for ARI shares, and they are all positive – for a unanimous Strong Buy consensus rating. The shares are currently trading at $9.83, and their average target price, $10.92, indicates an upside of 11% on the one-year horizon. (See ARI stock forecast)

OneMain Holdings (OMF)

Next on our list is OneMain Holdings, a financial services company that specializes in providing consumer loan services in the sub-prime customer niche. Like many financial services holding companies, OneMain operates through a subsidiary – in this case, OneMain Financial. The company traces its corporate roots back to 1912; in its current incarnation, it is based in Evansville, Indiana, and operates both online and through a network of 1,300-plus branches in 47 states.

The core of the company’s business is in personal loans. OneMain makes such loans available in amounts between $1,500 and $20,000, mainly to customers with credit problems but who own a vehicle and are able to manage a secured loan transaction. Payment terms range from 2 to 5 years, and interest rates range from 18% to 35.99%. While borrowers may face significant penalties for late payments, there are no penalties for early repayment. OneMain’s umbrella category for ‘loans serviced for our whole loan sale partners and auto finance loans originated by third parties,’ its primary personal loan category, is ‘managed receivables,’ and at the end of 3Q25, this category totaled $25.9 billion, up 6% year-over-year. In addition, OneMain also reported $3.9 billion in consumer loan originations on its books for Q3, a total that was up 5% year-over-year.

Through its loan business, OneMain aims to improve the financial health of hardworking people who might otherwise have difficulty accessing the banking industry. The company offers its customers features designed to make a difficult process comfortable, including a personalized loan calculator that can show an estimated monthly payment, and a ‘7-day okay’ policy, under which borrowers can change their minds and return the funds within 7 days of taking the loan.

When we look at OneMain’s financial results from 3Q25, we find that the company’s top line – reported as $1.6 billion in total revenue – was up 9% year-over-year. At the bottom line, the company generated $1.90 per diluted share, a non-GAAP EPS that was up 64 cents per share from the prior year.

The company’s earnings fully covered the common share dividend, which was increased 1% in the last declaration to a rate of $1.05 per share. At this rate, the company’s dividend annualizes to $4.20 per common share and gives a yield of 7%. OneMain has been paying out quarterly dividends and gradually raising the rates consistently since 2019.

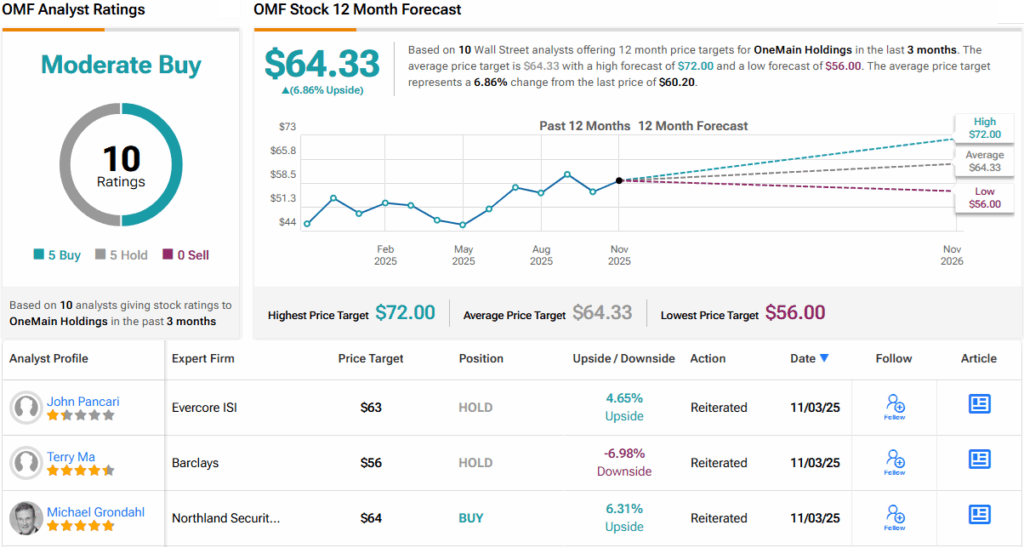

Moshe Orenbuch, of TD Cowen, covers this stock – and he liked what he saw in the company’s third-quarter report. Orenbuch wrote, “Mgmt continues to be constructive on credit trends, including the card book (which has high losses that are now stabilizing). Investors had been doubly concerned on OMF, both from a credit and a growth standpoint. This quarter, coupled with management’s outlook, shows that the company can grow profitably in the current environment, driving higher EPS and capital growth, in our view. This should allow the company to distribute more capital as well. Given the beat in revenue, the guidance raise as well as the prospect of increased capital return, we view the [third] quarter as positive.”

The Cowen analyst, rated by TipRanks among the top 5% of Wall Street’s experts, puts a Buy rating on OMF, along with a $72 price target that points toward a one-year upside potential of 20%. When factoring in the current dividend yield, the analyst sees the total return potential rising to 27%. (To watch Orenbuch’s track record, click here)

Overall, the Moderate Buy consensus rating on OneMain’s stock is based on 8 recent analyst reviews that split evenly between 4 Buys and 4 Holds. The stock is priced at $60.20, and its average price target of $64.33 suggests a gain of ~7% in the coming year. (See OMF stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.