On Thursday, the U.S. Securities and Exchange Commission’s (SEC) Office of Investor Education and Advocacy issued a bulletin that urged investors to exercise caution if they intend to invest in crypto asset securities. The SEC’s most recent caution to investors follows Coinbase’s (NASDAQ:COIN) disclosure that it received a Wells Notice from the SEC.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The SEC warned investors that investments in crypto asset securities can be “exceptionally volatile and speculative” and the platforms offering crypto asset investments or services may not be complying with applicable law, including federal securities laws. Further, it said, “Issuers of unregistered crypto asset securities offerings might not provide audited financial statements, depriving investors of this key information.”

The SEC also educated investors about the “Proof of Reserves” term used by crypto entities to describe a voluntary method to let users verify that an entity has sufficient reserve assets to cover customers’ holdings. This type of offering is made to ensure customers that their funds are safe and available upon demand. Nonetheless, the SEC feels that “crypto asset entities might use these in lieu of audited financial statements in order to obscure and confuse customers about the safety of their assets.”

The SEC Chair Gary Gensler has been cracking down on the crypto market since the collapse of Sam Bankman-Fried’s cryptocurrency exchange FTX. He has been emphasizing the need to regulate cryptocurrencies to protect investors.

On Thursday, Coinbase shares fell 14% in reaction to the company’s disclosure of a Wells Notice. The company feels that the potential enforcement actions against it would relate to aspects of its spot market, staking service Coinbase Earn, Coinbase Prime, and Coinbase Wallet.

Is Coinbase a Buy, Sell, or Hold?

Popular investor Cathie Wood’s investment management firm ARK Invest used the pullback in Coinbase stock to buy shares. On March 23, ARK Invest bought 268,928 Coinbase shares through its ARKK Innovation (ARKK) and ARKW Next Generation Internet (ARKW) exchange-traded funds or ETFs. It’s worth noting that on March 21, ARK Invest sold 160,887 COIN shares from its ARK Fintech Innovation ETF (ARKF).

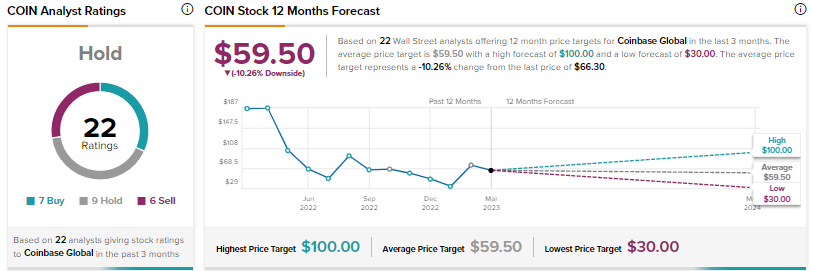

Meanwhile, Wall Street has a Hold consensus rating on Coinbase based on seven Buys, nine Holds, and six Sells. The average COIN stock price target of $59.50 implies 10.3% downside.