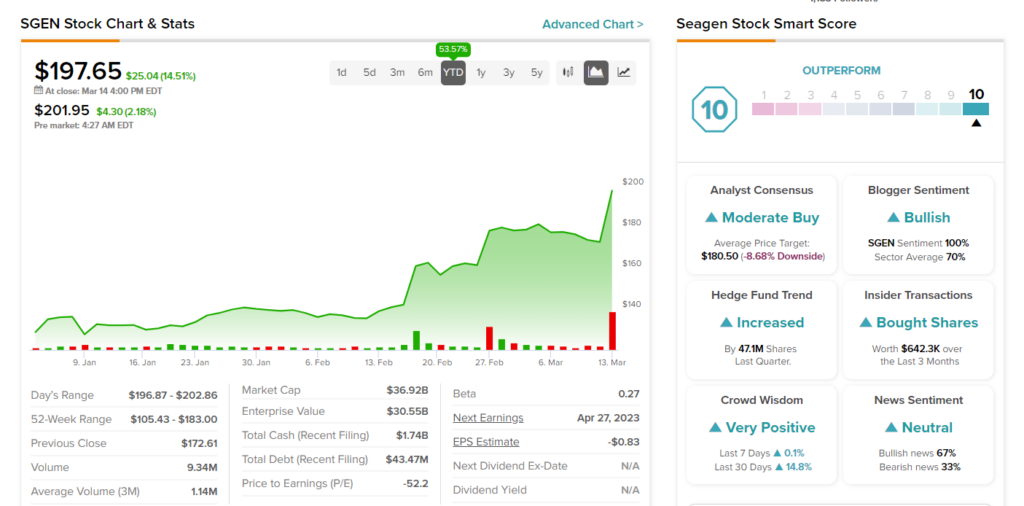

Looking for a stock that has outperformed the market average so far this year? One can check out Seagen (NASDAQ:SGEN), a cancer-focused biotechnology company. The stock has gained about 54% so far in 2023 and has the potential to increase further based on its lucrative valuation. On the flip side, analysts are not too optimistic about the stock’s prospects and have downgraded their ratings after Pfizer (PFE) announced plans to acquire Seagen.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Seagen stock seems to be undervalued despite the recent share price rally. Its forward price/sales ratio of 15.5x is trading at a discount of 10.3% from its five-year average of 17.28.

In addition, the overall summary signal of the technical analysis performed on SGEN stock is Buy. This signal considers various indicators to provide a stock’s overall technical strength.

Seagen’s 100-Day exponential moving average is 103.10, while its share price is $197.65, making it a Buy. Further, the stock’s Relative Strength Index (RSI) is 61.19, which indicates Neutral action. The RSI value indicates whether the stock is overbought or oversold. A higher value means the stock is overbought.

However, the acquisition announcement was followed by a series of analyst downgrades. About five analysts on TipRanks have switched their ratings on SGEN stock to Hold from Buy.

Nevertheless, the overall buzz around SGEN stock is positive. Also, both Pfizer and Seagen do not anticipate any roadblocks to the acquisition. The deal is expected to close in the fourth quarter of 2023 or early next year.

Is SGEN a Good Investment?

SGEN stock has nine Buy and 10 Hold recommendations, translating into a Moderate Buy consensus rating. Meanwhile, the average price target of $180.50 suggests 8.7% downside potential.

It is worth highlighting that investors following our Top Smart Score Stocks tool are likely to have benefited from the stock’s recent rally. This is because SGEN stock has been carrying a top-notch Smart Score of “Perfect 10” on TipRanks for the past 26 days. Shares with a perfect score have historically outperformed the broader market by a wide margin.