Hard drive maker extraordinaire Seagate (NASDAQ:STX) just took a serious hit from an analyst, who adjusted his rating downward in the face of shifting market conditions. Investors were promptly spooked and bolted from Seagate, carrying over 6.5% of Seagate’s market cap along with them.

The downgrade came from Barclays’ own Tom O’Malley, who found fault with Seagate’s rate of recovery in its hard drive sector. O’Malley dropped the rating from “overweight” to “equal-weight,” noting that there likely wouldn’t be a significant upgrade in the hard disk market until the first quarter of 2024. However, O’Malley didn’t adjust his $65 price target.

O’Malley also pointed out that there’s about to be a major technical shift in hard drives coming up next year, referring to the release of Heat-Assisted Magnetic Recording drives. This is a good point as well, as a major shift like that would likely prompt hard drive buyers to make their current drives last a little longer. Even if buyers didn’t go for the new drives, the old drives will likely be that much less expensive as a result. But Seagate isn’t going out quietly; it took advantage of Bethesda’s “Starfield” to release the Special Edition SDD Game Drives, which are three special drives for console storage. They come in two and five terabyte sizes, along with an eight terabyte version with extra USB ports. The drives also have the Constellation logo on them from the game, though that’s mostly decorative.

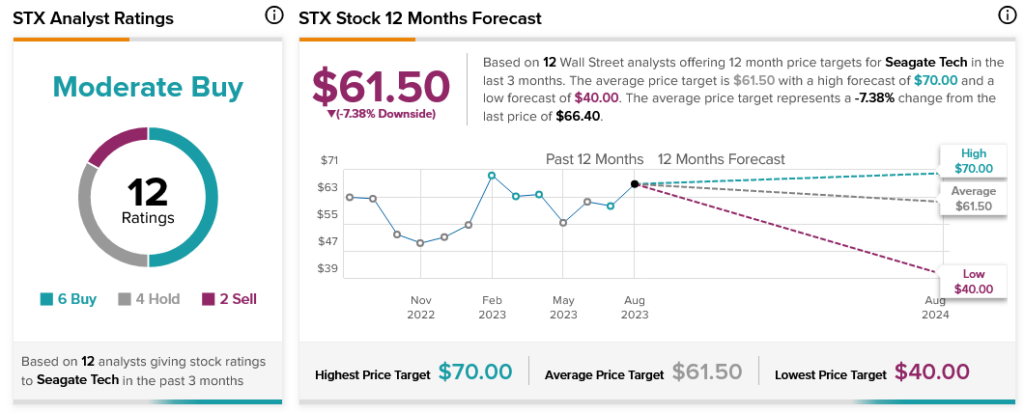

Overall, Seagate stock stands as a Moderate Buy according to analyst consensus based on six Buy ratings, four Holds, and two Sells. Nevertheless, Seagate stock comes with a surprising 7.38% downside risk thanks to its average price target of $61.50.