Data storage company Seagate Technology (NASDAQ:STX) has been fined $300 million by the Department of Commerce’s Bureau of Industry and Security (BIS) for continuing to sell hard disk drives to Huawei despite stringent export controls imposed on the Chinese company by the U.S. over national security concerns.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Seagate’s Violation of Export Controls

According to BIS, this is the largest stand-alone administrative penalty imposed by the agency. In 2019, Huawei and some of its non-U.S. affiliates were added to the Entity List, a U.S trade blacklist, to reduce the sales of goods to the company due to issues related to national security and foreign policy. Further, in August 2020, BIS imposed controls over the sale of certain foreign-produced items made with U.S. technology to Huawei.

Despite the August 2020 restrictions, Seagate shipped over 7.4 million drives to Huawei between August 2020 and September 2021. It became the sole supplier of hard drives to the Chinese company after two other suppliers ceased shipments in compliance with the new rules that became effective in 2020.

“Even after Huawei was placed on the Entity List for conduct inimical to our national security, and its competitors had stopped selling to them due to our foreign direct product rule, Seagate continued sending hard disk drives to Huawei,” contended Matthew S. Axelrod, assistant secretary for export enforcement.

Seagate’s $300 million penalty will be paid in installments of $15 million per quarter over five years, with the first payment due in October. As part of the resolution, Seagate agreed to three audits of its compliance program. It also faces a five-year suspension order denying its export privileges.

“While we believed we complied with all relevant export control laws at the time we made the hard disk drive sales at issue, we determined that engaging with BIS and settling this matter was the best course of action,” said Seagate’s CEO Dave Mosley.

Due to the settlement with BIS, Seagate postponed the announcement of its fiscal third-quarter results to Thursday, April 20, rather than its original schedule to announce the results post-market on Wednesday.

Is Seagate a Good Stock to Buy?

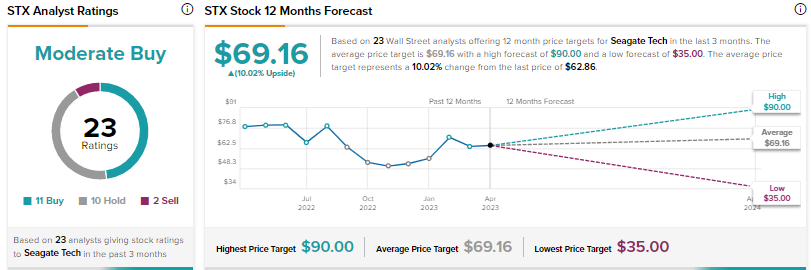

Wall Street is cautiously optimistic on Seagate stock, with a Moderate Buy consensus rating based on 11 Buys, 10 Holds, and two Sells. The average price target of $69.16 implies 10% upside potential. Shares have risen over 19% year-to-date.