Bank of Nova Scotia (BNS), Canada’s third-largest lender, beat profit expectations in the fourth quarter thanks to retail banking gains and lower provisions for credit losses. The bank raised its dividend by 11%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Earnings & Revenue

Net income came in at C$2.56 billion for Q4 2021 (C$1.97 per diluted share), up from C$1.9 billion (C$1.42 per share) for Q4 2021. Excluding one-time items, the bank earned C$2.10 per share, up from C$1.45 per share a year earlier. Analysts forecasted adjusted earnings of C$1.90 per share.

Provisions for credit losses fell to C$168 million from C$1.13 billion in the fourth quarter of 2021.

Adjusted earnings from Canadian Banking rebounded strongly, rising 59% year-over-year to C$1.24 billion.

Profit in the Global Banking and Markets division rose 9.1% to C$502 million.

Revenue rose 2.4% to C$7.69 billion, missing estimates of C$7.83 billion. (See Analysts’ Top Stocks on TipRanks)

Management Commentary

Bank of Nova Scotia president and CEO Brian Porter said, “We ended the year with strong fourth quarter earnings and exceeded our medium-term financial targets in fiscal 2021. Our diversified business model demonstrated its resilience through the pandemic, and the Bank is well positioned to achieve its full earnings power in the upcoming year. I am extremely proud of how the Scotiabank team supported our clients, customers and communities as they continued to navigate through the challenges of the pandemic, while also continuing to stay focused on creating long-term sustainable value for our shareholders.

“As we close out 2021, it is clear that our sharpened footprint and our significant investments in our digital capabilities have positioned the Bank for a very bright future.”

Wall Street’s Take

Following the results, Canaccord Genuity analyst Scott Chan kept a Buy rating on BNS with an C$88 price target. This implies 8.1% upside potential.

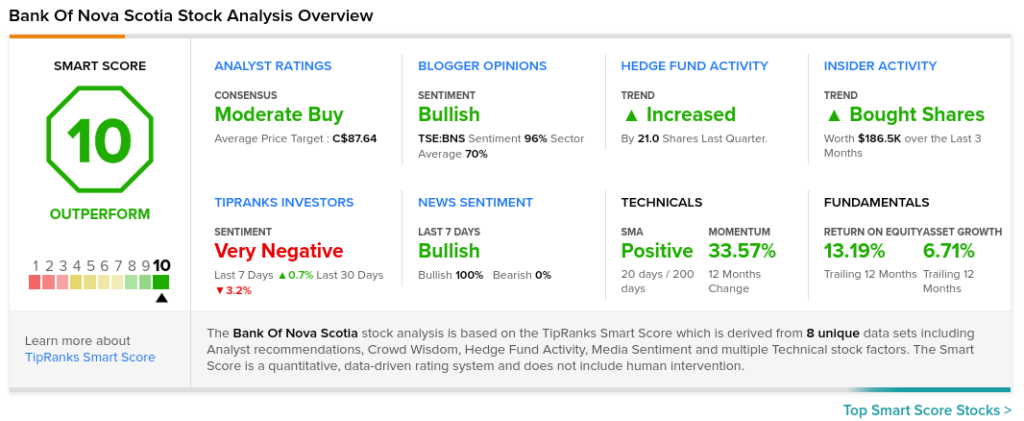

The rest of the Street is cautiously optimistic on BNS with a Moderate Buy consensus rating based on five Buys and two Holds. The average Bank of Nova Scotia price target of C$87.94 implies 8% upside potential to current levels.

TipRanks’ Smart Score

BNS scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock returns are very likely to beat the overall market.

Related News:

Scotiabank Q4 Earnings Preview: What to Expect

Scotiabank Donates C$400K to Professional Women’s Group Program

Scotiabank Increases Mental Health Coverage to C$10K