Scorpio Tankers (NYSE:STNG) is among the best-positioned stocks to take advantage of positive trends in the shipping sector and, more specifically, the tanker segment. We’re talking about a supercycle that is already revealing itself and could continue throughout the medium term. While Scorpio Tankers stock has performed well in recent months, it still looks underappreciated at 5.8x forward earnings, making me bullish.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tightness in the Sector

Supply is tight in the tanker sector — perhaps tighter than it’s been in a very long time. Global fleets are older than they’ve been in living memory, and there’s less new supply on order. Part of the reason for this is the pandemic, during which tanker fleets decreased in size, and many crews were retired from the industry. Also, because of falling demand and production uncertainties during the various lockdowns, companies were putting in fewer orders for new vessels.

In fact, very few tankers are being delivered between 2023-25. The tonnage that is set to come online is currently at a record low because orders for new vessels collapsed in 2020, falling to 67 from 112 in 2019. In the subsequent years, orders for new vessels have remained lower than average – 73 in 2021 and 91 in 2022. It’s worth noting that these vessels can’t be built overnight, and it can take up to five years to build a tanker.

Compounding the issue is a decline in shipbuilding capacity. According to data from Clarkson’s Research, there were only 131 large active yards in 2023, down from 321 at the height of the previous shipyard boom in 2009.

So, why is Scorpio in a prime position to benefit? Well, around a third of the global fleet is greater than 15 years old, and older vessels can’t qualify for prime trades, such as those with ExxonMobil (NYSE:XOM) or Vitol. Many of these older vessels have been used to evade sanctions placed on Russia by the US and its allies, coincidentally meaning they’re also in high demand.

Scorpio, on the other hand, has a sizeable and modern fleet, including the efficient LR2-type tankers. Scorpio vessels have an average age of eight years, and as such, the fleet is in a prime position to charge more. In Q1 2024, average daily rates were $39,357, up 20% from Q4 of 2023.

Two Additional Factors Impacting Shipping

There are two other major factors impacting shipping at the moment. These are Houthi attacks on vessels transiting the Bab el-Mandeb Strait and the drought affecting the Panama Canal. The former is causing vessels to reroute around the Cape of Good Hope as they transit between Asia and Europe. Singapore to Rotterdam takes 36 days on average via the Cape versus 26 through the Red Sea. It’s also adding up to 70% more time at sea for Gulf-Mediterranean trade.

This is compounded by the fact that, due to new environmental regulations, vessels can’t go significantly faster. Meanwhile, the Panama drought is significantly delaying cargo transit through the canal. The nation recently had its driest October since the 1950s. The resultant low water levels have seen the permitted number of vessels passing through the waterway fall from around 50 to just 18 per day.

The net impact of these disruptions is actually positive for the tanker trade. It’s a case of less supply, and it has sent “day rates” – the cost of leasing or hiring a vessel – surging. Moreover, it’s worth recognizing that demand for tankers is strong, perhaps stronger than analysts expected in 2024, driven by higher refinery output and robust demand for oil and gas products.

Is Scorpio Tanker Stock a Buy, According to Analysts?

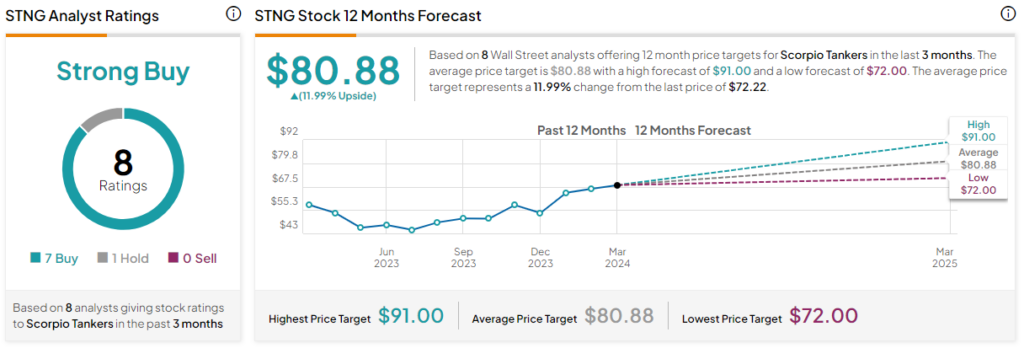

Scorpio Tankers is a Strong Buy, according to analysts. There are currently seven Buys, one Hold, and zero Sell ratings. The average Scorpio Tankers stock target price is $80.88, inferring 12% upside from current levels. The highest target is $91, and the lowest is $72 – marginally below the current share price.

The Bottom Line

Challenges in the Bab al-Mandeb Strait and the Panama Canal probably won’t last forever. However, the conditions are set for a multi-year supercycle in the shipping sector. Risks? There are always risks. There could be a material fall in demand if OPEC were to cut oil production. Likewise, a cessation of hostilities around Yemen could see some pullback in day rates.

Nonetheless, given the tightness of supply, the company’s comparatively young fleet, and the current robust demand for hydrocarbon products, Scorpio could really prosper in the coming years. Moreover, at just 5.8x forward earnings, it’s a very enticing offering.