Schlumberger (NYSE:SLB) shares jumped nearly 2% in the early session today after the energy solutions provider delivered a robust set of fourth-quarter results and boosted its quarterly dividend by 10%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

During the quarter, revenue increased by 14% year-over-year to $8.99 billion, outpacing expectations by $30 million. Moreover, EPS of $0.86 exceeded estimates by $0.03. For the full year, revenue increased by 18% to $33.14 billion, and net income attributable to Schlumberger jumped by 22% to $4.2 billion. Furthermore, free cash flow for the year stood at $4.04 billion.

In Q4, while North American revenue remained largely unchanged, revenue from the company’s International segment jumped by 18% over the prior year period. Additionally, revenue from SLB’s Reservoir Performance and Production Systems verticals clocked robust double-digit increases. A major portion of this growth came from SLB’s acquisition of the Aker subsea business.

The company expects record investment levels in the Middle East over the coming periods. It also expects robust activity continuation across Brazil, West Africa, Southeast Asia, and the Eastern Mediterranean. Notably, SLB used its cash flow to reduce its net debt by $1.4 billion. The company also returned $2 billion to investors in the form of dividends and share repurchases during the year.

Add to this, SLB has hiked its quarterly dividend by 10% to $0.275 per share. The SLB dividend is payable on April 4 to investors of record on February 7. The company also expects to increase its share repurchases in 2024.

Is SLB a Good Stock to Buy?

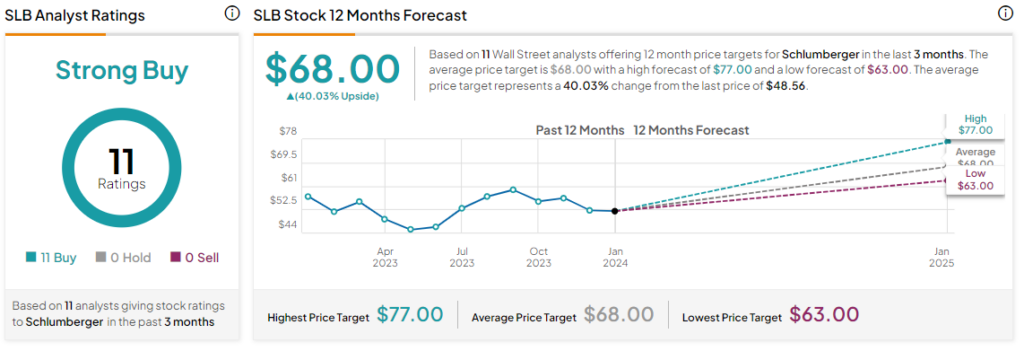

Overall, the Street has a Strong Buy consensus rating on Schlumberger, and the average SLB price target of $68 points to a mouth-watering 40% potential upside in the stock. But that’s after a nearly 15% decline in SLB’s share price over the past year.

Read full Disclosure