In a recent SEC filing, Lucid Group (NASDAQ:LCID) disclosed that The Public Investment Fund (PIF), the sovereign wealth fund of the Kingdom of Saudi Arabia, bought about 85.7 million shares of the EV manufacturer at an average price of $10.7 per share. The total value of the investment is $914.9 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The latest investment raised the fund’s ownership to 1.1 billion Lucid shares. It is worth mentioning that PIF is the majority shareholder at Lucid.

The Saudi Wealth Fund’s investment is part of the company’s recent $1.52 billion capital raise. The remaining $600 million was raised through an at-the-market offering of 56.2 million shares of its common stock.

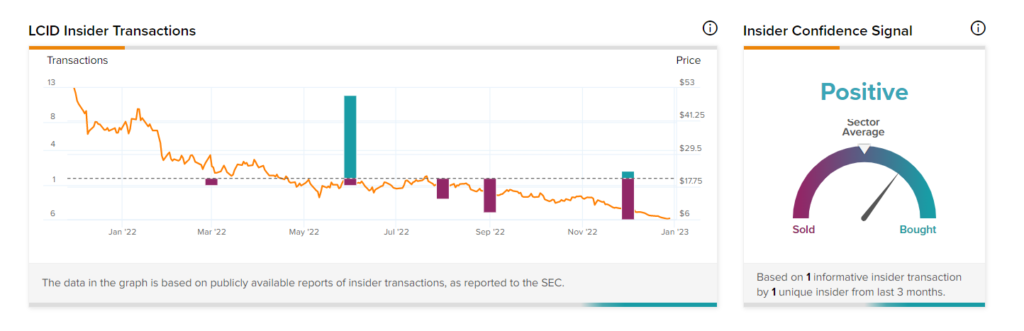

After this major insider buy transaction, the TipRanks’ insider confidence signal on LCID stock is positive.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Lucid’s Risk Factors

According to the new Tipranks Risk Factors tool, Lucid reported 89 risk factors that may affect its business. One of these key factors that investors should note is the company’s dependency on its Chief Technology Officer and CEO, Peter Rawlinson. The CEO has a considerable influence on Lucid’s technology development and business plan. The corporation could suffer a serious setback if Rawlinson discontinues his service for any reason.

Is LCID Stock a Buy?

Turning to Wall Street, LCID has a Hold consensus rating based on three Buys, two Holds, and three Sell ratings. The average Lucid price target is $14.74, implying 131% upside potential.

In contrast to insiders, hedge funds are currently bearish on the stock. Based on the 13F filings of 468 Hedge Funds, LCID stock has a negative hedge fund confidence signal. They decreased holdings of LCID stock by 4 million shares in the last quarter.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.