Saudi Arabian Oil Co. (Aramco) and TotalEnergies (NYSE:TTE) recently awarded engineering, procurement, and construction contracts worth $11 billion for the development of Amiral, a new petrochemical complex in Saudi Arabia. The companies had made the final decision to jointly build the complex in December 2022.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Importantly, contracts for this phase have been awarded to seven different companies, including Hyundai Engineering & Construction, a subsidiary of Hyundai Motors (HYMTF), Maire Tecnimont, Sinopec Engineering Group Saudi, and others.

The agreements were signed on Saturday in a ceremony attended by Amin Nasser, president and chief executive of Saudi Aramco, and TotalEnergies CEO Patrick Pouyanne.

New Saudi Arabia Petrochemical Complex

The Amiral petrochemical complex is anticipated to expected to house the largest mixed-load steam crackers in the Gulf, with the capacity to produce 1,650 kilotons annually of ethylene and other industrial gases. Steam crackers play a vital role in petroleum refineries, as they utilize heat and steam to break down lighter hydrocarbons into smaller molecules.

Furthermore, the new complex is anticipated to boost the country’s economy, as it would result in over $4 billion in additional investments from different sectors. Also, around 7,000 jobs are expected to be created within the kingdom once the complex becomes operational.

The deal is expected to be mutually beneficial for both companies. This is due to the promising outlook of the global petrochemicals market, which is projected to experience a compound annual growth rate of 7% over the next seven years, according to Grand View Research.

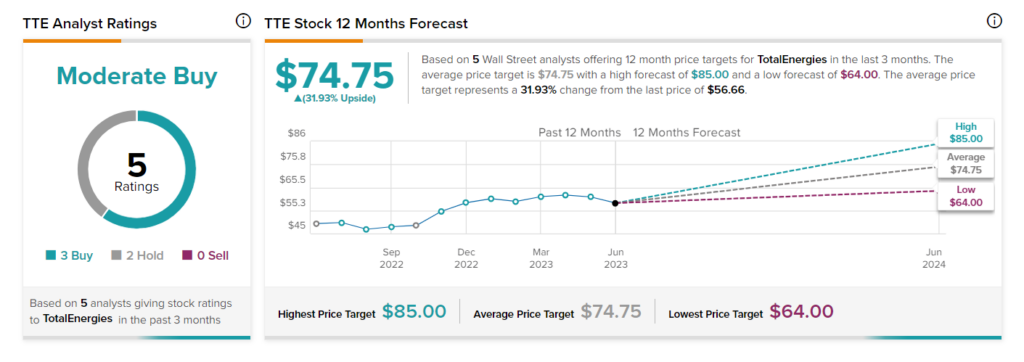

What is the Forecast for TTE?

In addition to the Amiral project, TTE is actively investing in the production of clean energy, a sector that holds promising potential due to the increasing global demand. Also, the stock has an attractive dividend yield of 4.16%, and its strong cash position makes capital deployment activities sustainable.

Overall, Wall Street analysts are cautiously optimistic about TTE stock. On TipRanks, TotalEnergies has a Moderate Buy consensus rating based on three Buys and two Holds. The average TTE stock price target of $74.75 implies 31.93% upside potential from current levels.