After reporting a 69% decline in its operating profit in Q4, Samsung Electronics (GB:SMSN) expects its earnings to plunge again in Q1. The slump in demand for memory chips and the significant price decline weighed on the revenue and profitability of this multinational electronics company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Samsung expects its Q1 revenue to decline by about 19% year-over-year. Moreover, its top line is forecasted to decrease by 11% on a quarter-over-quarter basis. Weak revenues are likely to weigh on its bottom line, which the company expects to decline by approximately 96% year-over-year in the first quarter.

The prolonged high inflation and continued pressure on consumer spending slowed the demand for personal computers (PCs) and smartphones. Moreover, the manufacturers of smartphones and PCs are witnessing inventory issues as they stocked up a massive amount of chips during the pandemic-led demand.

Given the challenging operating environment, Samsung’s semiconductor business is under pressure. Notably, its operating profit in the semiconductor business fell about 97% in Q4 due to lower demand and a price decline.

What’s the Prediction for Samsung Stock?

The company expects macroeconomic challenges to continue to hurt demand and pricing for memory chips in the first half of 2023, which, in turn, weighs on its short-term financials. Nonetheless, the company expects the demand environment to improve in the second half, which will lead to a recovery in its sales and operating profit.

Furthermore, the company’s dominant competitive positioning in the semiconductor and premium smartphone segments offers a strong foundation for long-term growth.

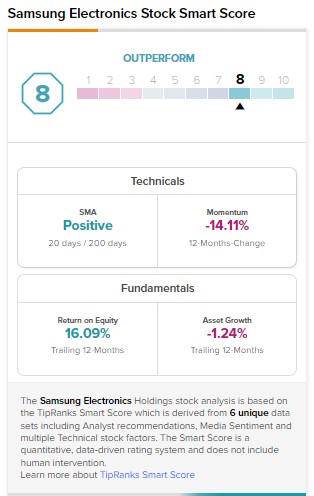

Samsung stock carries an Outperform Smart Score of eight on TipRanks.