The world’s leading consumer electronics maker, Samsung Electronics (GB:SMSN), expects a drop of 69% in its consolidated operating profit in Q4 compared to the prior year. Further, its operating profit is expected to decline by 60% quarter-over-quarter. Samsung will announce its fourth-quarter earnings on January 31.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company said that prolonged high inflation and the fear of recession have adversely impacted consumer demand for PCs and smartphones. This, in turn, affected Samsung’s memory and mobile experience businesses. In addition to weak demand and macroeconomic uncertainty, inventory adjustment issues remained a drag.

Given the challenges, Samsung expects its top line to decline by about 9% year-over-year in Q4. Further, sales are expected to decrease by 8.6% sequentially.

Is Samsung a Good Buy?

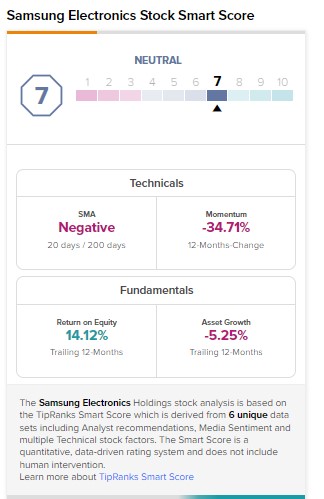

The weak macro environment could continue to pose challenges for Samsung in the short term. However, its dominant competitive positioning augurs well for long-term growth. Overall, at current levels, Samsung stock has a Neutral Smart Score of seven on TipRanks.