Samsung Electronics (SSNLF) is seeing a boost in investor interest after reports confirmed it scored Nvidia’s (NVDA) approval to supply high-performance memory chips for AI applications. This milestone boosts Samsung’s foothold in the AI chip market. Meanwhile, this approval gives Nvidia a stronger supply chain and access to high-quality HBM chips to meet rising AI demand.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Samsung’s shares in South Korea gained nearly 5% on Monday, reaching a one-year high.

Nvidia’s Stamp Could Boost Samsung’s AI Future

Market reports say Samsung has met Nvidia’s standards to supply high-bandwidth memory (HBM) chips for AI applications. According to people familiar with the matter, Samsung has advanced with its newest chips and is expected to receive Nvidia’s final HBM3E certification soon.

Meanwhile, Goldman Sachs analyst Giuni Lee sees this as a strong sign for Samsung, as it can match the industry’s toughest requirements. He also noted that even with low investor expectations, Nvidia’s approval is a clear positive for Samsung.

Prior to this, the Korea Economic Daily reported that Samsung’s 12-layer HBM3E chips have also passed Nvidia’s qualification tests, clearing them for use in AI accelerators that run models like ChatGPT and DeepSeek. This green light positions Samsung to challenge SK Hynix in the high-end HBM market.

However, Samsung’s shipments to Nvidia will likely stay limited this year since most orders are already booked with SK Hynix and Micron (MU). Still, it’s a meaningful win for Samsung, which faced doubts about its HBM technology after earlier delays.

What This Means for Nvidia

With this potential tie-up, Nvidia would gain access to a larger supply of high-quality HBM chips, which will help meet surging demand for AI hardware. Notably, expanding its supplier base also reduces production bottlenecks and supports Nvidia’s ambitious growth plans in AI markets.

With a reliable new source of HBM chips, Nvidia can more confidently ramp up AI product rollouts, from data-center GPUs (graphics processing unit) to supercomputing solutions. Notably, HBM chips are advanced memory modules that deliver very fast data transfer speeds, used in GPUs and AI accelerators.

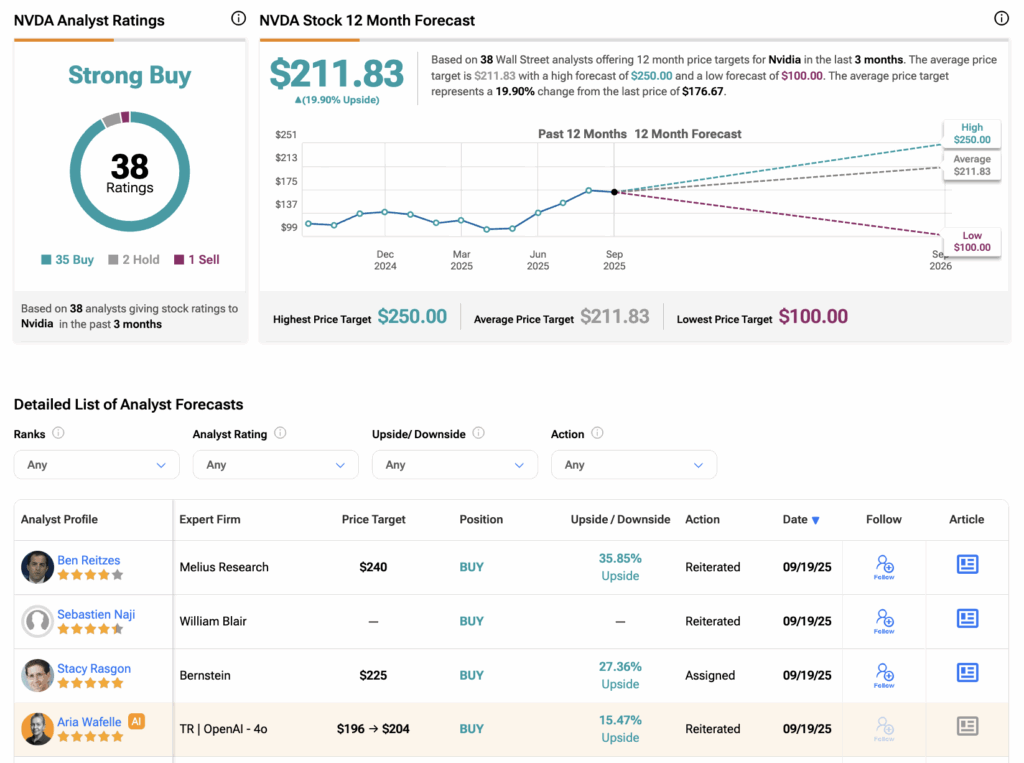

Are Nvidia Shares a Good Buy?

According to TipRanks, NVDA stock has a Strong Buy consensus rating based on 35 Buys, two Holds, and one Sell assigned in the last three months. At $211.83, the Nvidia stock price target implies a 20% upside potential.