Samsung Electronics (GB:SMSN) will reportedly increase chip production capacity at its largest manufacturing site, the P3 factory in Pyeongtaek, South Korea. The move is likely to boost Samsung’s market share growth in the long run.

Samsung plans to add new lines of 12-inch wafer capacity for DRAM memory chips and 4-nanometre chip capacity at the P3 factory. Furthermore, the company plans to increase its extreme ultraviolet lithography equipment by at least 10 units so as to ensure advanced DRAM and foundry production.

Interestingly, Samsung’s expansion plans contrast with forecasts for sluggish chip demand in the near future due to the global economic slowdown and inflation’s impact on consumer spending. According to the World Semiconductor Trade Statistics, the global semiconductor market is expected to decline by 4.1% in 2023.

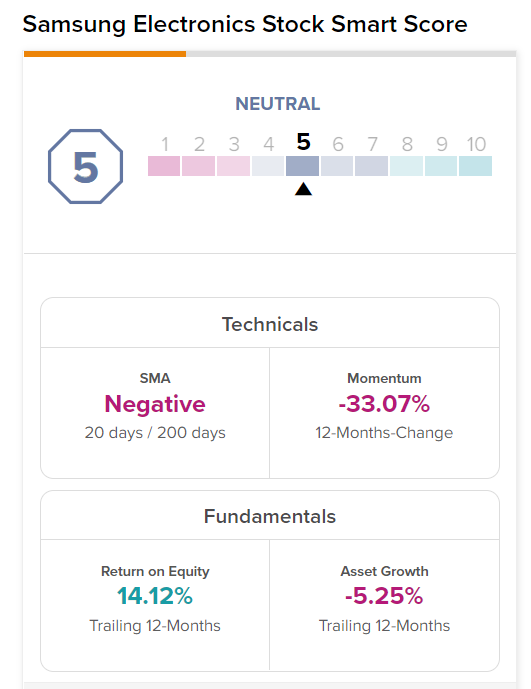

Samsung is widely known for its consumer electronics business and is also a global leader in technology. The stock has a Smart Score of 5 on TipRanks, indicating that it will perform in line with market averages.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.