There was good news out of Baird today, and software provider Salesforce (NYSE:CRM) was the beneficiary therein. Or rather, should have been the beneficiary, as Salesforce shares were down modestly in Tuesday afternoon’s trading session despite the positive outlook that Baird offered up. Baird, via analyst Rob Oliver, noted that Salesforce now has an “attractive” risk-reward profile, which should draw more attention from investors.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Although Oliver did acknowledge that there are some macroeconomic issues that weigh on the notion of selling software, there are some paths to victory for Salesforce. These include price hikes, better sales execution, and a potential “…return of front office spending.” That’s part of why Oliver just recently hiked Salesforce to an Outperform, along with better free cash flow than most expected.

Why Are Investors Selling?

This is all pretty good news, but why aren’t investors snapping at the notion and picking up shares? One reason might be some recent insider selling. In fact, Salesforce has a “Very Negative” rating based on three informative transactions from the last month, including CEO Mark Benioff, who’s been selling stock in batches for the last few weeks. And with Benioff also fending off the notion of a “Hiroshima moment” in AI development, that likely doesn’t help matters.

What is the Future Outlook for Salesforce?

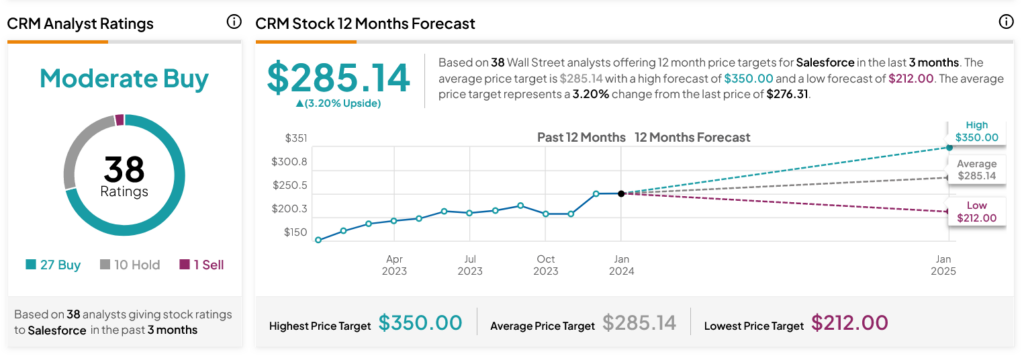

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CRM stock based on 27 Buys, 10 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 78.6% rally in its share price over the past year, the average CRM price target of $285.14 per share implies 3.2% upside potential.