RTX Corp’s (NYSE:RTX) Pratt & Whitney unit is planning to expand the capacity at its Singapore engine center by about two-thirds.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The 48,000-square-foot expansion at the Singapore center is part of Pratt & Whitney’s global investments to support its GTF fleet. The engine center, a joint venture between SIA Engineering Company and Pratt & Whitney, is a part of the company’s GTF MRO Network.

Over the last four years, the GTF MRO network has more than doubled in operations, with 13 active engine centers at present. The company expects to add six more centers to the network by 2025.

RTX shares have plummeted by nearly 15% over the past month after a rare condition in powder metal used in the production of certain engine parts on its Pratt & Whitney GTF fleet resulted in the company recognizing an associated charge in the third quarter. This is expected to impact its top line as well as bottom line this year.

The consequent engine removals and shop visits are also expected to result in an increased number of aircraft on the ground. The company expects an impact in the range of $3 billion to $3.5 billion on its pre-tax operating profit over the next several years.

Is RTX a Good Stock to Buy Now?

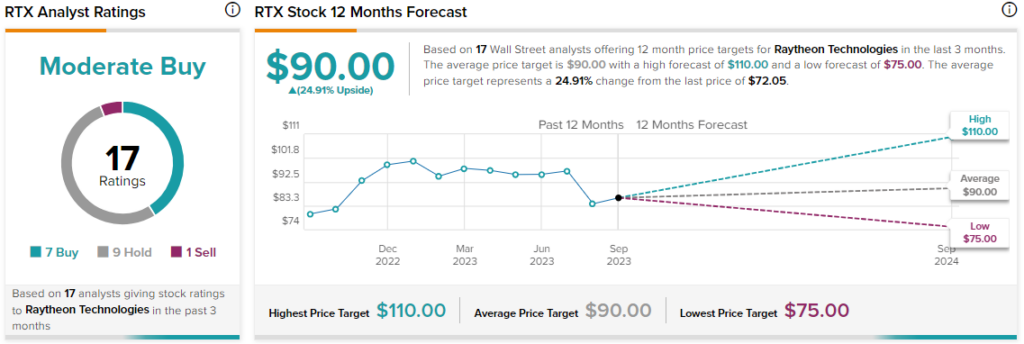

Overall, the Street has a consensus price target of $90 on RTX, alongside a Moderate Buy consensus rating. This points to a 25% potential upside in the stock.

Read full Disclosure